The Business Sale Report would be nothing without its loyal subscribers, inspiring us to curate and provide the best possible information regarding businesses to entrepreneurial opportunists like yourselves. From heavily researched industry insights and sector-specific how-tos, to our vast selection of available businesses for sale and distressed companies, what we do behind the scene is entirely a result of your views and business-related interests, not to mention your desire to be exceptional in incredibly competitive and saturated marketplaces.

We started the Monthly Updates insight series last month, to shift the focus to you, our subscribers. Instead of examining general worldwide trends and activities, our Viewer Insights for the last 30 days takes an in-depth look into the activity of your competitors to see: what sectors were viewed the most on the Business Sale Report website, which pages and industries appeared most popular, and the top businesses that piqued interest.

Above all, we will aim to draw comparisons to last month, and explain exactly why.

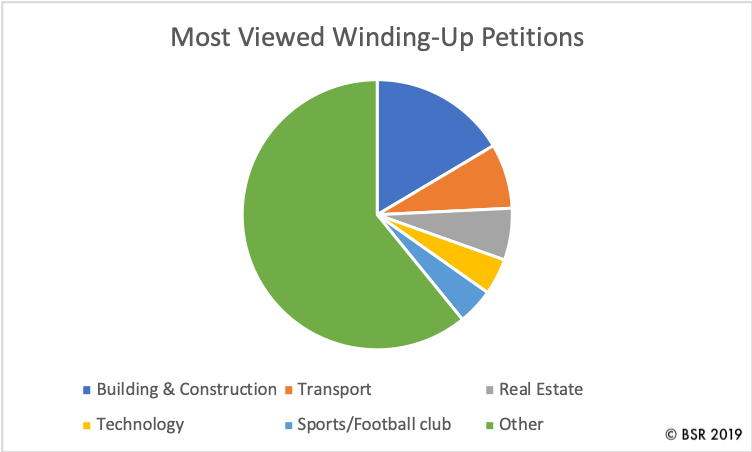

Winding-Up Petitions

Insolvent businesses that are facing winding-up petitions are being forced into compulsory termination in order to pay off its creditors by liquidating the company’s assets.

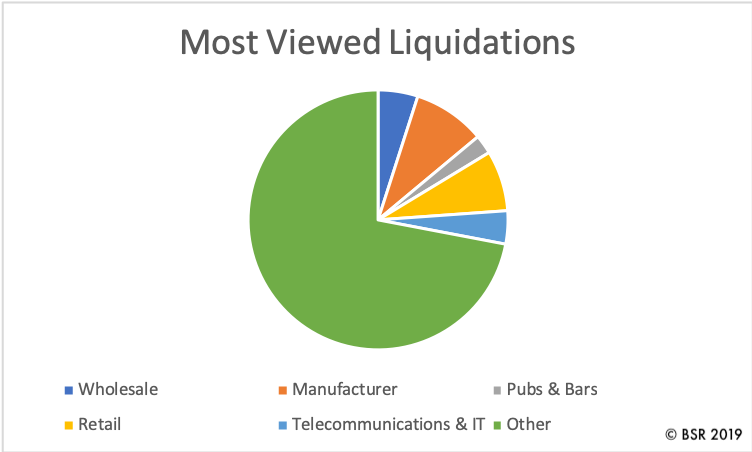

Liquidations

When an insolvent business cannot pay off its financial obligations, the company goes into liquidation. Its assets are distributed to interested clients and the creditors are reimbursed, bringing the company to an official end by striking it off the Companies House list.

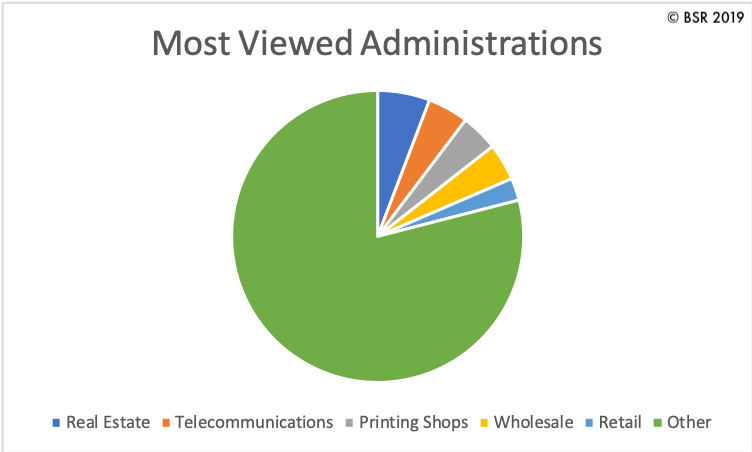

Administrations

A business in administration means that control of the company has been passed on to a licensed insolvency practitioner to leverage assets or restructure the company as necessary in order to repay creditors or ensure profitability in the future.

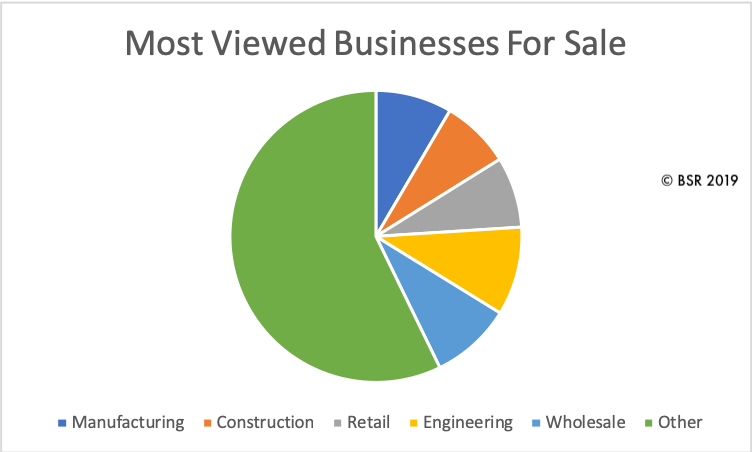

Businesses For Sale

For existing businesses to grow their portfolios and take a greater share of the market, acquisitions are the way forward. And because acquisitions are often linked in terms of industries and for businesses to enhance their service offerings, it is unsurprising that views were varied across the board. Over half of all the views (57.22 per cent) were from the ‘Other’ category!

The company is a well-established specialised contractor offering commercial decoration services across Central Scotland, known for its strong relationships with Tier 1 construction organisations and preferred contractor status. With a diverse projec...

This market-leading business specialises in bespoke, luxury kitchens and whole-house furniture, with expertise in handmade designs using responsibly sourced local hardwoods. Catering to high net-worth individuals, the company boasts a strong team and...

A well-established travel company with over 14 years of experience, it specialises in weekend breaks, five-day adventures, and summer holidays across the UK and Europe, offering the convenience of a door-to-door pick-up service. The business benefits...

FREEHOLD

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.