There is no single way to value a business. However, if you are considering the sale of your company, it is likely that you will want to know how much you can expect to achieve from the sale – both for planning and marketing purposes.

Thankfully, most sellers tend to use one of four main methods as the best way of valuing their company, through assessing: price-to-earnings ratio, asset valuations, entry cost, and discounted cash flow. Below, we’ve explored each of these methods, in turn, providing an insight into the businesses that may suit each option, as well as an example of calculations for each.

Business Valuation Factors

No matter what valuation method you choose, you will have to consider one or more of your business’ assets and factors.Price-to-earnings ratio

The method of valuing a business by price-to-earnings (P/E ratio) is arguably the most common. It is considered the best choice for a business demonstrating strong profits as it can indicate both high forecasted growth and a track record of repeat business.Asset valuation

Asset valuation is often the method of choice for strong and stable businesses brimming with tangible assets, such as property and machinery.Entry cost

The concept of entry cost is just as it appears – the cost of creating your business from scratch should you start again.Discounted cash flow

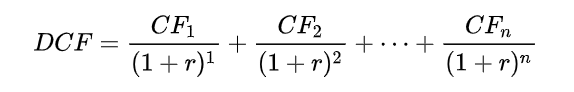

Discounted cash flow is a complicated valuation method that is almost exclusively used by large, established businesses such as energy companies that are likely to be able to predict cash flow.

This is a unique opportunity to acquire valuable intellectual property assets from a well-established wholesaler with many years of experience in the discount food and non-food sector in the Midlands.

This is an opportunity to acquire a long-established specialist bakery business, supplying major UK supermarkets and boasting a fully equipped production facility with a skilled workforce.

Discover the rare chance to acquire a specialist UK supplier of marine engines and generators, noted for their leadership in the used marine engine market and hard-to-find parts.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.