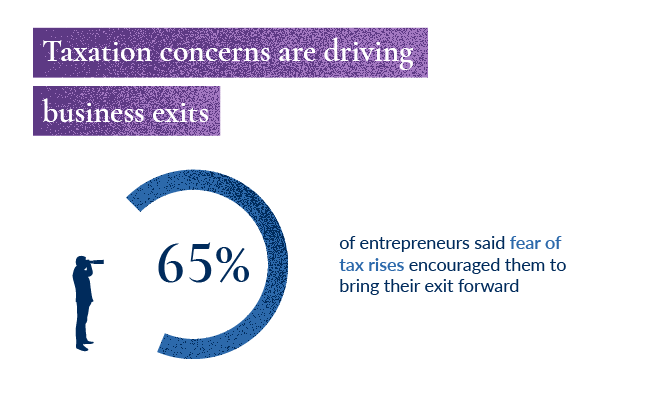

A new survey on motivations behind business sales has revealed that over half of entrepreneur respondents (56%) are considering an early business exit over concerns about tax rises. Of those who have already sold, nearly two-thirds (65%) said fear of tax hikes drove them to exit their business early.

The research, conducted by London-based private and commercial bank Arbuthnot Latham & Co, underscores the anxiety many founders feel in the face of changing tax policies - particularly in the wake of recent and upcoming changes to Business Asset Disposal Relief (BADR) and Investors' Relief.

Action steps for entrepreneurs

If you are concerned about tax and thinking about your exit, consider these immediate actions:

Start formal exit planning now. Engage experienced advisers - M&A specialists, tax planners, wealth managers - to map your optimal path.

- Benchmark your business readiness. Assess where value gaps exist and set up a 90-day sprint plan to start closing them.

- Align business and personal goals. Ensure that your personal financial planning (retirement, estate, philanthropic goals) matches your business strategy. Consult with a wealth planner well in advance for advice on how to plan, manage, and structure the personal wealth from an exit.

- Monitor tax policy developments. Stay informed, but avoid reactive decision-making based purely on tax fears.

This is a unique chance to purchase a well-established vineyard and winery set in the beautiful countryside of South East England. Please note that the deadline for expressions of interest is Friday May 9th at 4pm with a deadline for final offers Wed...

Opportunity to acquire a multi award-winning specialised construction company with expertise in cleaning, repair, and conservation of historic stonework and decorative surfaces. Offers are invited from serious buyers by close of business, 9 May 2025,...

A well-established London based consultancy with expertise in complex international environments is seeking immediate equity investment or a sale of the business and/or its assets. Interested parties are advised to express their interest by 5:00 p.m....

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.