What is a data asset?

The sheer volume of data that is being produced is astounding...and sometimes frightening.What impact can data assets have on my company’s valuation?

The valuation multiples achieved by businesses that are data-driven, are often higher than others. This applies to businesses in different or the same industries. In addition, businesses that have strong data assets are finding that competitors are approaching them to try to buy their data assets, or even to simply use them.Methods for valuing data

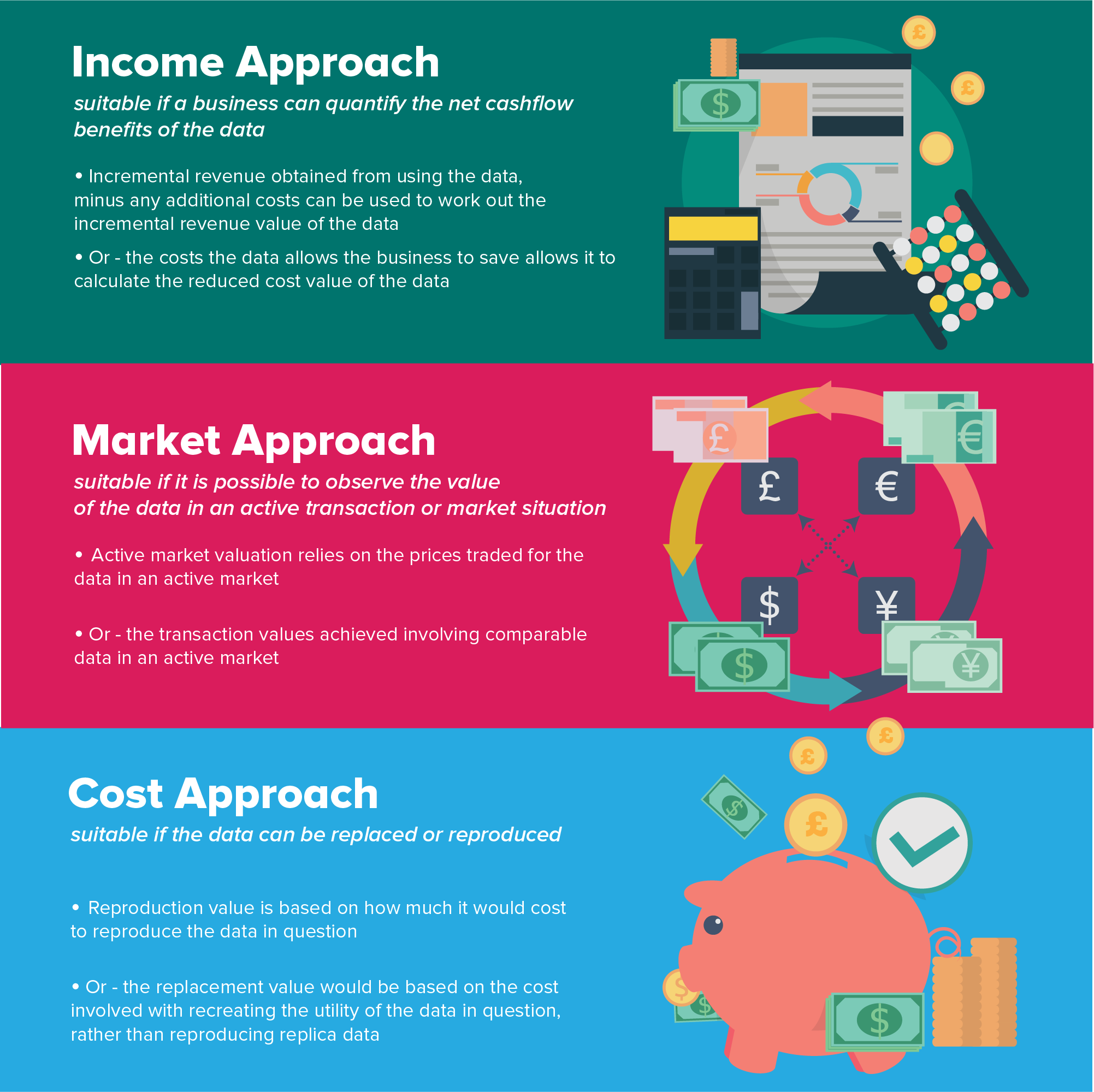

There is no set agreed method of putting actual valuations on data, but the Income, Market and Cost methods commonly used to value an asset also apply to data:

The company is a well-established specialised contractor offering commercial decoration services across Central Scotland, known for its strong relationships with Tier 1 construction organisations and preferred contractor status. With a diverse projec...

This market-leading business specialises in bespoke, luxury kitchens and whole-house furniture, with expertise in handmade designs using responsibly sourced local hardwoods. Catering to high net-worth individuals, the company boasts a strong team and...

A well-established travel company with over 14 years of experience, it specialises in weekend breaks, five-day adventures, and summer holidays across the UK and Europe, offering the convenience of a door-to-door pick-up service. The business benefits...

FREEHOLD

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.