In the world of business, the brand is king. A business provides a product or service granted, but it is a brand that builds and sells to a customer base.

Having something great to sell to customers is only part of the battle; selling it in volume is often the real challenge. To achieve this, customers must be aware the product exists and trust the business selling it. Awareness, trust, reputation, loyalty, repeat business – that is the power and value of a strong brand. And that is why buying a business for its brand can be so worthwhile.

Benefit from an Established Brand

It takes time and consistency to create an effective money-making brand, so buying a business that already has a strong brand identity can provide a great foundation for growth and ultimately profit.

This approach is best suited to individuals or businesses that have a quality product or service that is either unbranded or still relatively unknown. In these instances, it can be difficult to get the business off the ground, so entering the market via acquisition – in this case buying another business whose brand is already well established – provides an immediate platform from which to launch the product or service.

Importantly, therefore, a business buyer must assess if the identity, reputation and customer base of the brand they are buying is suitable for their intentions post-acquisition.

Nike’s acquisition of the Converse brand back in July 2003 is a good illustration of this. Nike was hardly struggling to establish itself in the footwear market. However, it had become known specifically as a maker of sports shoes, thus limiting the company’s reach.

Converse, meanwhile, had established itself as an alternative brand for those looking to be different from the mainstream – it had built a loyal customer base and an instantly recognisable style. So when Nike acquired Converse for $305 million 12 years ago, it gained instant access to a new demographic and, moreover, the company inherited a brand that had such a strong following that turning a profit by attaching the Converse logo to new shoe designs proved easy.

This example also demonstrates another point: one company will often have multiple customer-facing brands under its roof. Indeed, even small businesses can often have several revenue streams – different types of products or services – which each have their own brand. And so, businesses can be bought as a bolt-on acquisition, with their brands being used to complement, enhance or diversify the buyer’s existing offerings.

A Platform to Launch New Products

To look at a more recent and reasonably-priced example, at the end of April 2015 cosmetics firm Swallowfield announced that it had bought the Real Shaving Company brand for £1.17 million. Chris How, chief executive of Swallowfield, explained when the deal was announced that the strength of the shaving firm’s brand was the key motivator for the acquisition, giving Swallowfield a popular logo and packaging with which to dress up and sell its own products.

Mr How said: "We are delighted to acquire such a well-established and well-loved brand that will increase the branded element of our business, in line with our stated strategy.

"We look forward to bringing our industry leading innovation, both in packaging and formulation, to the Real Shaving brand, driving profitable growth in the future."

This shows the power a strong brand can have. A great product with poor or unknown branding can often struggle, particularly in competitive markets. However, attach a badge that carries with it a positive reputation and loyal customer base and immediately the acquired brand adds immense value to the buyer’s business portfolio.

Distressed Businesses, Strong Brands

Buying a branded business does not always have to involve a costly merger or acquisition though; there are also distressed businesses with strong brands attached to them. Unfortunate circumstances can see a firm slide into administration or liquidation even if they have a well-known and popular brand, and this in turn presents a great opportunity for potential business buyers.

Buying a distressed business often provides better value because of the pressured situation the seller finds himself or herself in. Take the example of confectionery company JE Wilson & Sons, which entered administration on 22 May 2015 but was bought the very same day by Creative Confectionery.

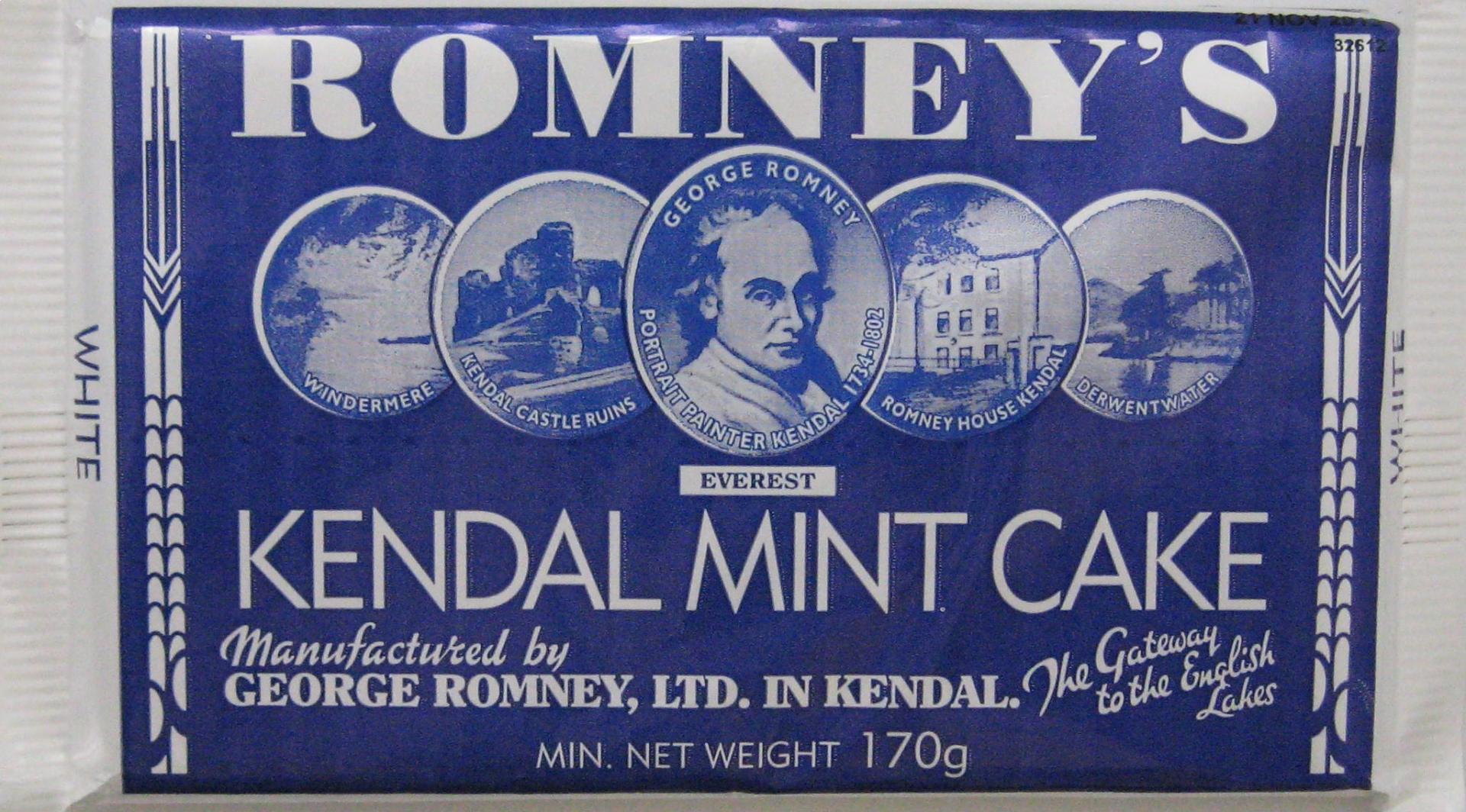

The name JE Wilson & Sons might not ring any bells to most people, but the business’ brand and main product – the Kendal Mint Cake – probably will. In production for over a century, it is one of the UK’s best known sweets, particularly popular among climbers and mountaineers because of its high energy content.

Again the strength of the Kendal-based brand, which had been built over 100 years, was at the forefront of the buyer’s mind. With its supply chain and contacts among high street retailers, Creative Confectionery could combine its own strengths with that of the brand to hopefully change the fortunes of the Kendal Mint Cake.

By incorporating the branding aspect of the failing company within its own larger and more stable operations, the buyer identified an easy way to grow its business. It is an example that other business buyers could look to follow. And importantly, as shown here, the ability to identify distressed opportunities before or as soon as they enter administration gives the buyer a head-start on competitors, sometimes enabling a deal to be done before others are even aware the business is in a state of distress.

Maintaining Resale Value

As highlighted in the case of JE Wilson & Sons, another benefit of a strong brand is that it retains its value. So long as a brand evolves apace with its market and the reputation and quality behind the brand does not diminish, it will always be an attractive acquisition opportunity for a business buyer.

This makes buying a business with a good brand a solid investment. Furthermore, it illustrates the value of consciously building a brand with an exit strategy in mind – ensuring consistent quality and service over a long period of time will help grow a brand to a stage where it will achieve far more money in a sale than a business’ products or services ever would by themselves.

For business buyers, acquiring a firm for its already established brand name will eliminate the initial hard work required in creating and marketing a brand identity from scratch. This in turn will allow the buyer to start targeting an established audience from day one, boost revenue by selling its own products or services under the newly acquired brand, and grow its own portfolio of brands so the business can enter new markets or gain a greater share of one it is already present in.

Search businesses for sale

Represents an opportunity for an acquirer seeking a three surgery, predominantly private dentistry located in Pembrokeshire.

FREEHOLD

Predominately NHS dental surgery with scope for physical expansion, private growth and extended services.

FREEHOLD

Represents an opportunity for a dental practice acquirer seeking a seven surgery mixed dentistry operating since 1978.

FREEHOLD

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.