Thu, 02 Jan 2025 | DIVISION SALE

Scottish engineering group Wood has completed the sale of its stake in Aberdeen-based EthosEnergy to private equity firm One Equity Partners.

The deal for Aberdeen-based EthosEnergy is worth $138 million (£111 million) and was first announced by the London Stock Exchange listed John Wood Group in August 2024. It was officially completed on New Year’s Eve.

Wood Group owned 51 per cent of EthosEnergy, a joint venture set up in 2014 with German industrial giant Siemens.

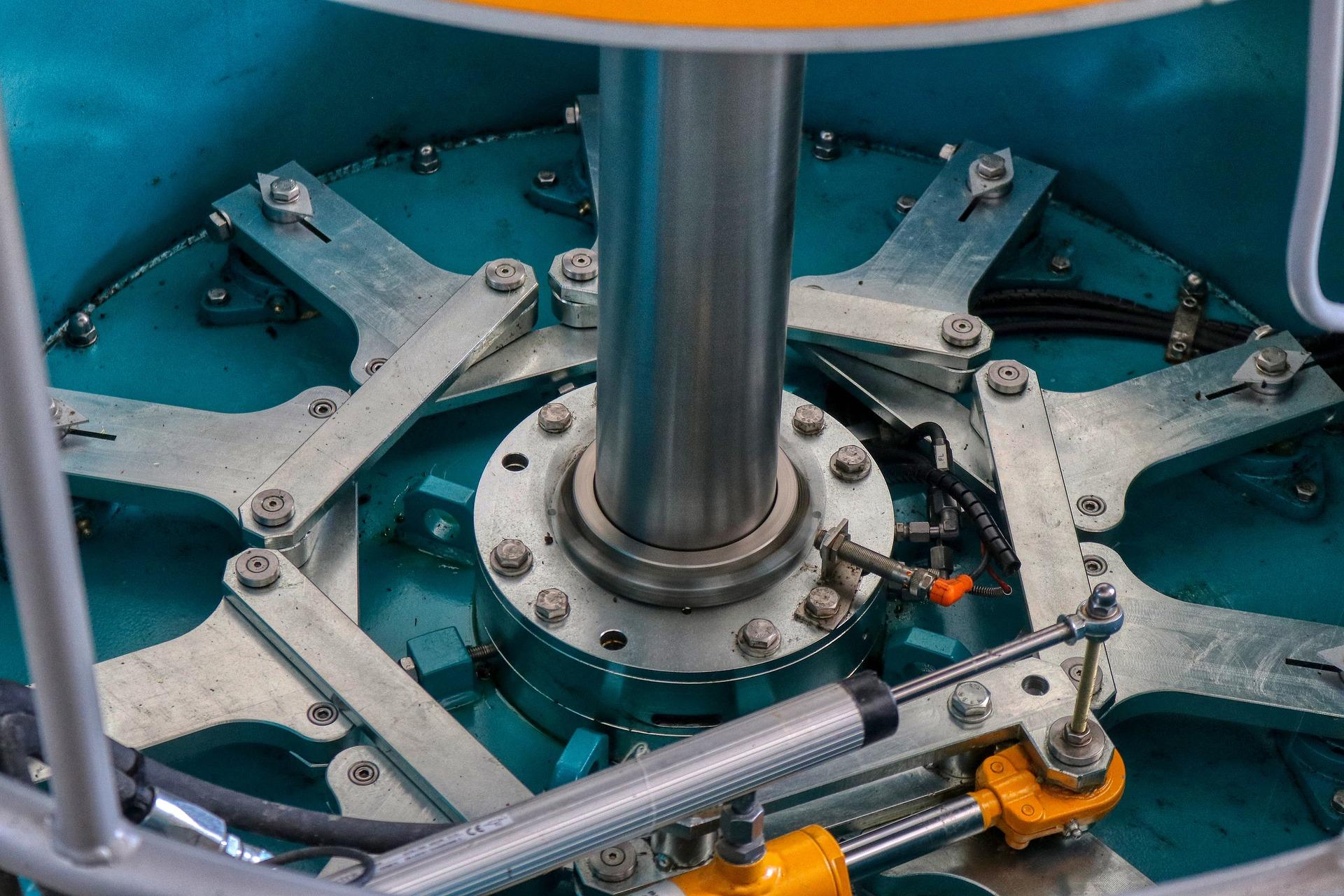

Ethos, which was part of Wood's Investment Services business unit, makes turbines and other rotating equipment such as steam turbines, heavy gas turbines, generators, transformers and compressors. Its work covers a range of sectors such as industrial, oil & gas, aerospace and power generation.

Its clients and partners include Toshiba, Sacramento Municipal Utility and Repsol Resources.

It employs around 3,600 staff globally and operates in over 100 countries. It contributed $34 million of adjusted EBITDA to Wood’s results in 2023.

Ken Gilmartin, CEO of Wood, said: "We are pleased to complete the sale of EthosEnergy to One Equity Partners. This strategic divestment is part of our strategy to be selective and focused on our core business. We will continue to align our portfolio as part of our commitment to simplify Wood."

One Equity Partners is a middle market private equity firm focused on the industrial, healthcare, and technology sectors in North America and Europe. Since 2001, the firm has completed more than 400 transactions worldwide. It has offices in New York, Chicago, Frankfurt and Amsterdam.

At the time of the announcement in August, Ante Kusurin, partner at One Equity Partners said that EthosEnergy was ‘uniquely positioned to meet the growing maintenance needs of an aging turbine fleet’.

It was also benefiting from trends such as emerging market growth, adoption of electric vehicles, electrification of heat and other industrial functions, increasing data centre demand, and a growing share of ‘intermittent’ renewable capacity that relies on dispatchable gas power to stabilise the grid.

Find out more about overseas private equity appetite for UK firms

Currently seeking buyers interested in the business and assets of a structural steel fabrication business based in the North West of England.

This successful UK-based company, established in 2018, offers a unique opportunity to acquire a thriving business with a strong reputation among cosmetic creators focusing on bath and body products.

This opportunity offers a well-established precision manufacturing business with a reliable customer base, strengthened by on-site customer-owned tooling.

|

16

|

|

Apr

|

Bristol's Giftcloud bought by European peer Recharge | BUSINESS SALE

Bristol-based digital rewards platform Giftcloud has been bo...

|

15

|

|

Apr

|

Banked snaps up consumer payments app VibePay | BUSINESS SALE

Global Pay by Bank platform, Banked, has bought UK-based con...

|

15

|

|

Apr

|

Dack Motor Group buys struggling peer MotorServ UK | BUSINESS SALE

Solihull based MotorServ UK has been bought by Lincolnshire&...

|

04

|

|

Dec

|

Victorian era engineers Cross and Morse in management buy-in | MBO/MBI

A Victorian era engineering company has been acquired throug...

|

31

|

|

Jan

|

Capita hits divestment target with £111m Trustmarque sale, but targets further disposals | BUSINESS SALE

Outsourcing and professional services firm Capita PLC has an...

|

30

|

|

May

|

Proposed sale of Amec oil and gas to make way for merger | MERGER

Wood Group has put the majority of Amec Foster Wheeler'...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.