Wed, 04 Dec 2024 | MBO/MBI

A Victorian era engineering company has been acquired through a management buy-in.

T.D. Cross Limited, trading as Cross and Morse, has been bought by Michael Capewell’s Astwood Group supported by a multimillion-pound asset-based lending (ABL) suite of facilities from Aldermore Bank.

The funding supports the businesses acquisition, the ongoing working capital, and the company’s growth plans.

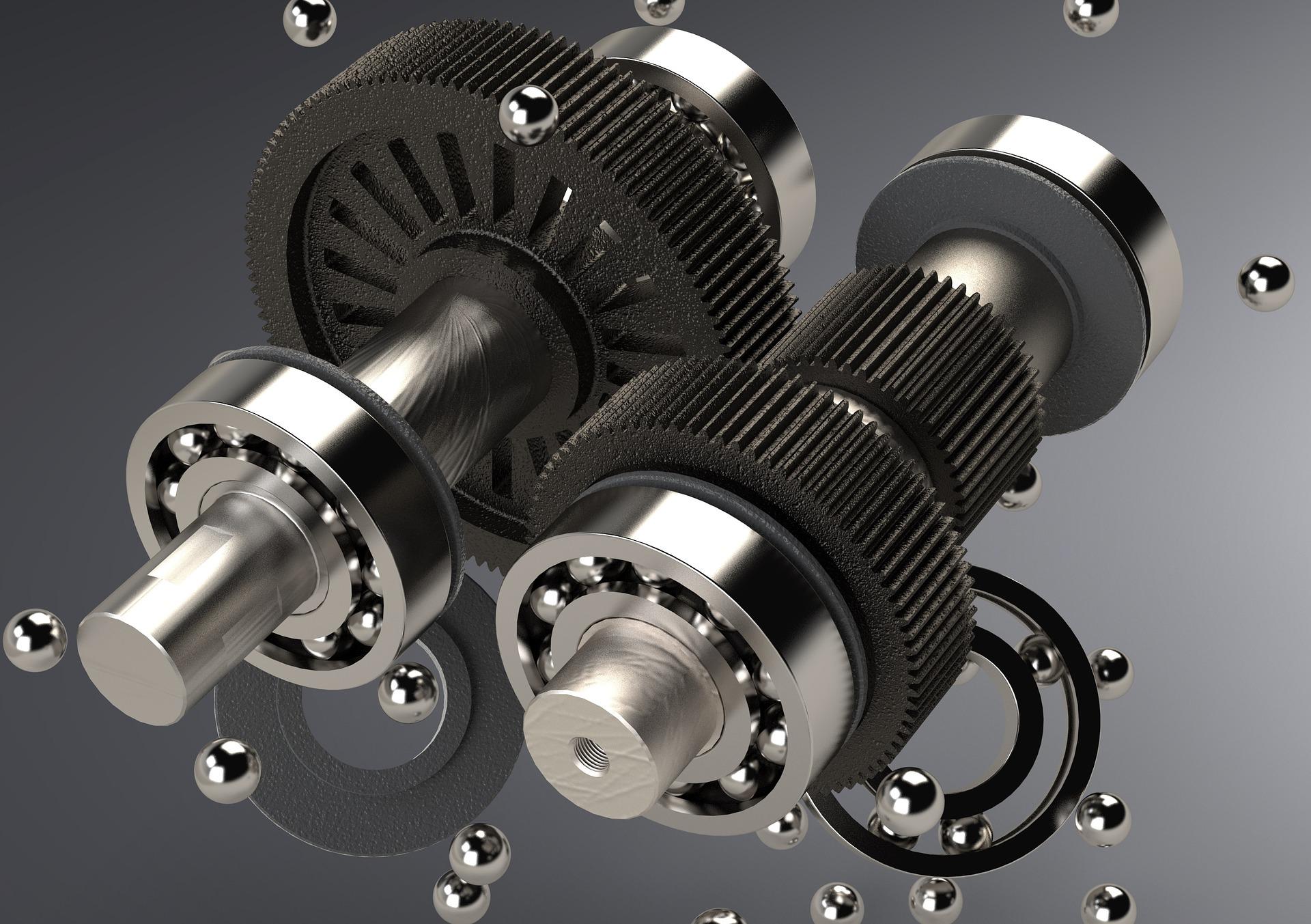

Cross and Morse was founded in 1870 by Thomas Damby Cross specialising in supplying the gun trade. It now provides specialist, bespoke engineering and manufacturing services and power transmission products such as gears, roller chains, classical timing belts and freewheel clutches to clients across the globe.

It is the largest authorised distributor and stockist for American transmission products manufactured by Regal-Beloit (formerly EPT) in the United Kingdom.

It caters to a wide range of industries such as oil and gas, steel and sewage treatment plants.

Capewell will take over stewardship of Cross and Morse from David Shadbolt and Mike Scudamore who have been with the business for more than 40 years.

Capewell said he was impressed with the stability, history and brand of Cross and Morse, “making it a superb fit with Astwood Group's objective of seeking to own and grow established engineering businesses in the Midlands”.

Mark Robinson, business development manager for invoice finance at Aldermore, said: "We are delighted to work with Michael, providing him with a tailored solution to support the transaction. We're excited to see his growth plans for Cross and Morse, building on the success of the business to date.”

The transaction was supported by Heligan Group on the corporate finance side, RJS, mfg Solicitors and Attwoods and Prime Accountants.

Matt Croker, Director of Heligan Corporate Finance, said: “We are pleased we were able to find a buyer who we think will be a true custodian of the business.”

Find out more about buying a company with a long trading history

This independently run Heating Engineers delivers a variety of reliable services to a wide range of clients in its local area.

A substantial industrial electrical installation company, incorporating a full design and build service is being marketed for sale. Equally adept at managing both small and large projects and with experience in multiple sectors, it has developed a pa...

A well established and strongly profitable engineering business, located in the Midlands. The company will be an attractive acquisition for both a larger trade buyer and also those looking for a stable engineering business.

|

17

|

|

Apr

|

MGroup set to buy infrastructure peer Telent | BUSINESS SALE

Technology infrastructure giant Telent is set to be acquired...

|

16

|

|

Apr

|

Glenfield Storage Solutions collapses | ADMINISTRATION

Glenfield Storage Solutions, a Leicester specialist in wareh...

|

16

|

|

Apr

|

Pulse Cashflow Finance carries out MBO to help under-pressure UK firms | MBO/MBI

Pulse Cashflow Finance has undergone a management buyout (MB...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.