Fri, 01 Dec 2023 | ADMINISTRATION

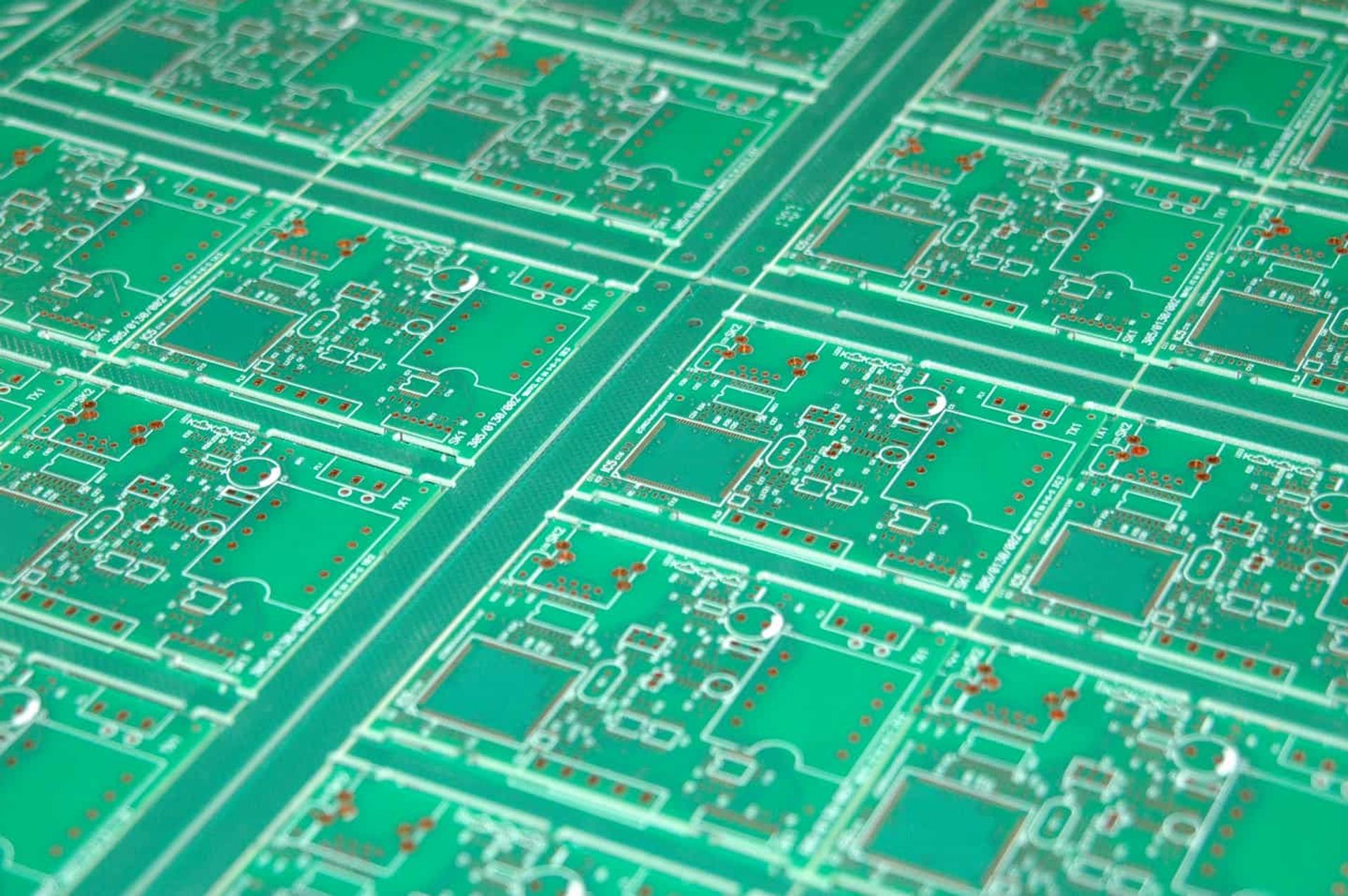

Washington-based electronics manufacturer Faraday Printed Circuits has fallen into administration and ceased trading. The company, which had operated for more than 35 years, supplied printed circuit boards for the global electronics manufacturer.

The company was established in 1987 and had expanded from a 4,000 sq ft operation to a 22,300 sq ft site, prior to being impacted by a drop in orders amid challenging trading conditions. Allan Kelly and Andrew Haslam of FRP Advisory were appointed as joint administrators, but were unable to find a buyer for the company.

As a result, Faraday was forced to cease trading, with all 39 staff made redundant. The administrators are now preparing to sell the company’s assets and have urged interested parties to get in touch. In the company’s accounts to the year ending May 31 2023, its fixed assets were valued at around £737,000, while liabilities amounted to approximately £1.2 million.

Joint administrator and FRP Restructuring Advisory Partner Allan Kelly commented: “Unfortunately, like many other businesses in the manufacturing industry, Faraday Printed Circuits was not immune to a significant fall in demand and mounting external pressures, most notably rising costs, made the business financially unviable. Regrettably, this meant 39 employees have now been made redundant. We’re supporting the individuals affected with filing their claims with the Redundancy Payments Service."

More than two decades ago, the company had formed strategic partnerships with several Asian printed circuit board fabricators, in response to the rapid globalisation of the electronics manufacturing industry.

According to the company, this arrangement enabled it to deliver tailor-made products for its global customer base, including fast turnaround prototypes and medium volume production, from its base in the North East of England, while being able to fulfil higher volume orders via its network in Asia with reduced production costs.

Find out more about the M&A trends shaping dealmaking in the manufacturing industry

This timber product and treatment plant in the Midlands presents a unique opportunity for industry professionals seeking to expand their operations in a prime location.

An established steel fabrication business in the East Midlands offers an attractive opportunity for those looking to enter or expand in the industry.

Established over 15 years ago, the business manufactures, supplies and installs structural steelwork. The company also designs and fabricates high quality steel products for internal and external applications.

|

11

|

|

Apr

|

Vortex Companies buys sewage and drainage peer McAllister | BUSINESS SALE

Texas-based Vortex Companies, a global providers of trenchle...

|

10

|

|

Apr

|

PE-backed Cyberfort buys ethical hacking group ZDL | BUSINESS SALE

Berkshire-based Cyberfort, the cyber security services and s...

|

10

|

|

Apr

|

Law firm Farleys buys historic Wigan pier firm ABH | BUSINESS SALE

Lancashire law firm, Farleys, part of legal services group L...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.