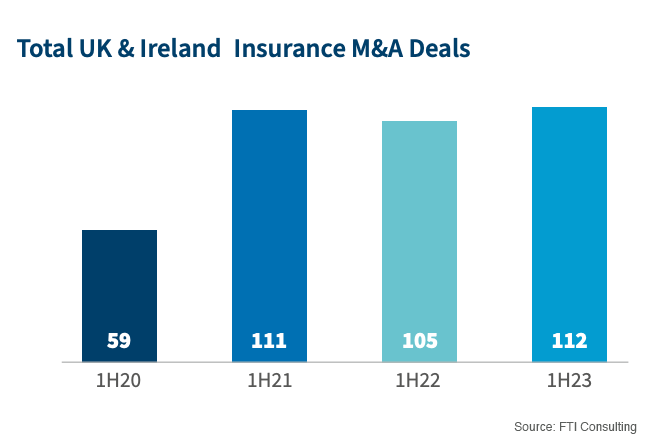

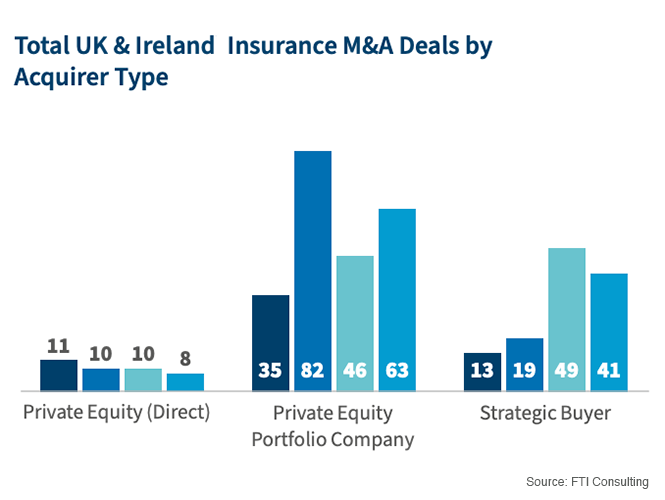

Insurance M&A in Europe has reached new heights this year, pushed by booming activity in the broking subsector, increasing private equity dealmaking and add-on and bolt-on acquisitions made by consolidation platforms.

Insurance M&A - How things stand in 2023 so far

Insurance M&A on the rise in Europe and the UK – But has dealmaking peaked?

Why the shift to broker deals?

Is broker activity poised to drop?

When discussing fragmentation in the broker sector and the ongoing scope for consolidation, one can look at The Clear Group as an exemplar. The group was first established in 2001 and since then has completed around 50 acquisitions.

With backing from Goldman Sachs, the firm has ramped up its acquisitive activity this year, completing 10 acquisitions in 2023 so far. The Clear Group’s acquisition strategy is aimed at adding complementary businesses that simultaneously strengthen its existing services, expand its offering (for example, its recent acquisition of Thomond Underwriting – the group’s first MGA deal) and enable it to expand its geographic presence.

Starting out in London, the company has used acquisitions to expand into Sussex, Kent, the Midlands, Yorkshire and, lately, into Ireland. Following its most recent acquisition, which saw the group take on South West-based brokerage Bluestone Insurance Services, Clear Group CEO Mike Edgeley reaffirmed the company’s commitment to acquiring more brokers across the UK.

Discussing the company’s M&A strategy with Insurance Times in the wake of the Bluestone deal (the group’s third acquisition of September 2023), Clear Group Executive Chairman Howard Lickens said that the group was “deliberately fussy” and that it regularly opted against acquiring good businesses that didn’t fit its model.

Lickens said that the group seeks to assess synergy with target businesses, considers all stakeholders, not simply Clear Group shareholders and assesses the suitability of a company’s existing management team prior to making an acquisition.

Despite some forecasts elsewhere that broker consolidation might be poised to dry up, Lickens said that Clear Group is aiming to ramp up its M&A activity, saying that 2023 has been the company’s most acquisitive year “by far” and that he expects this to accelerate.

As well as expanding into Ireland with two recent acquisitions, Lickens says the group is now actively looking at spreading to Europe and is targeting mainland European businesses that might fit its business model.

JMG Group is a Yorkshire-based insurance group that was established in 2020. Since then, the group has undergone rapid acquisitive expansion, acquiring more than 20 insurance brokers, including 10 deals this year.

The company was formed through the SYNOVA-backed MBO of JM Glendinning Insurance Brokers and it has grown to have a network of over 25 offices and more than 450 staff across the UK. The company targets acquisitions of businesses with similar cultures and expertise.

Once companies have been acquired, they typically continue trading under their existing brand, meaning minimal disruption to customer service, while certain back-office functions are centralised with JMG. This gives the group a particularly attractive proposition to owners at small brokerages, who are facing growing regulation and evolving customer expectations.

The group’s most recent acquisition was Blackfriars Group, a liability and business insurance provider for UK SMEs. Outlining the benefits of joining JMG, Blackfriars Group director Steven Lewis said that centralising administration such as compliance and business management would free up time to focus on clients and support the team in further developing their roles.

JMG recently demonstrated its dedication to acquisitive growth with the appointment of Tanish Cheema to the newly created role of Group Integration Co-Ordinator. In this role, Cheema will support the group’s senior acquisition team with the integration of new businesses.

What about insurance carrier M&A?

Opportunity to acquire an established motor and transport business in the beautiful region of Somerset.

Opportunity to acquire a renowned takeaway business established as a local landmark in Leighton Buzzard.

LEASEHOLD

This is an exciting opportunity to acquire a well-established company with a diverse and loyal client base, backed by accredited safety standards and a strong management team. Perfect for serious buyers, this business offers a sturdy asset portfolio...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.