The team behind the Business Sale Report operates with you, our loyal subscribers, in mind. Every piece of information that we generate and curate on the website is a result of your views and business-related interests – we aim to provide you with the best possible information to meet the needs of entrepreneurial opportunists like yourselves. From hosting a range of distressed businesses and companies for sale that may pique your interests, to writing how-to guides and thoroughly-researched industry insights, our goal is to assist you in being completely informed to stay ahead in an incredibly competitive and saturated marketplace.

It has now been three months since we started our Monthly Updates insights series, to shift the focus to you, our subscribers. Instead of examining general worldwide trends and activities, our Viewer Insights for the last 30 days takes an in-depth look into the activity of your competitors to see: what sectors were viewed the most on the Business Sale Report website, which pages and industries appeared most popular, and the top businesses that sparked interest.

Above all, we will aim to draw comparisons to the previous two months to provide a quarterly assessment, and explain exactly why.

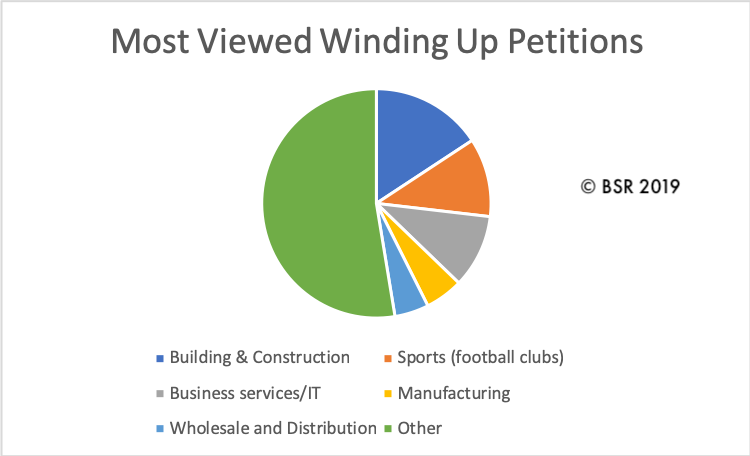

Winding-Up Petitions

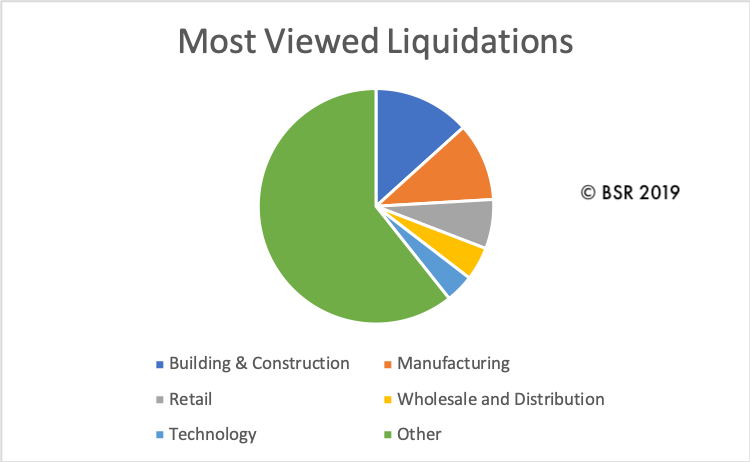

Liquidations

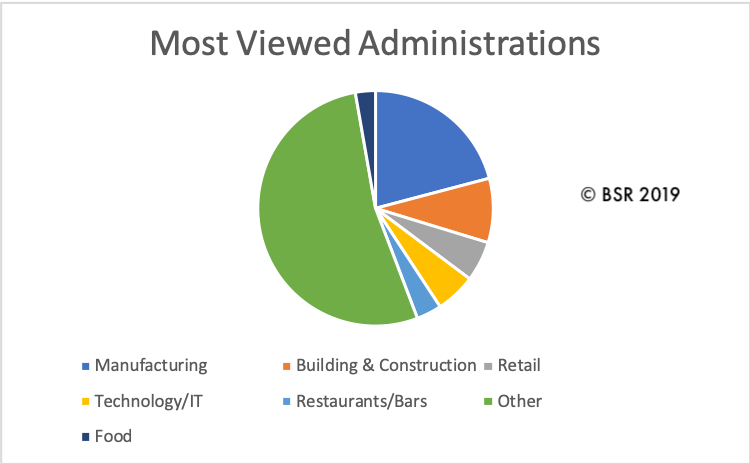

Administration

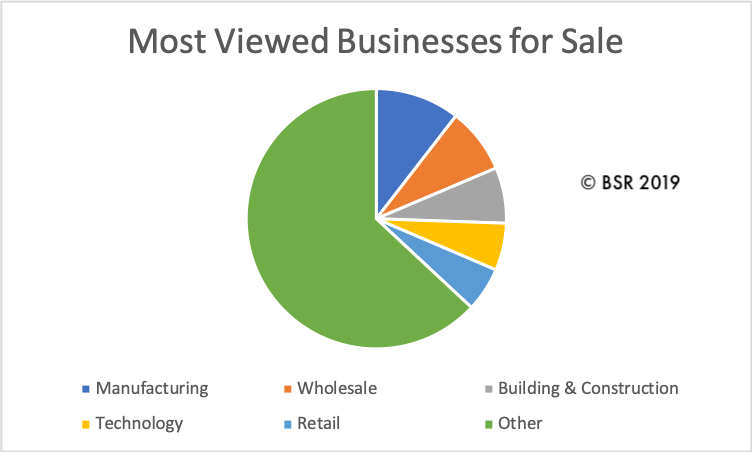

Businesses For Sale

This well-established scrap vehicle yard in Essex offers a unique opportunity to acquire a business with a significant stock of decommissioned parts and panels, alongside essential equipment such as forklifts and heavy demolition plant.

Opportunity to acquire a well-established engineering product and equipment distributor located in the heart of the West Midlands.

Presenting an exceptional opportunity to acquire a well-established specialist joinery business located in Southport, Merseyside.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.