It is you, our loyal subscribers and business opportunists, that make the Business Sale Report what it is. Our curated selection of businesses for sale and distressed businesses, as well as our thoroughly researched industry insights and sector-specific how-tos, are largely inspired by your views and business-related interests, not to mention your desire to be competitive in such booming marketplaces.

Therefore, for a change, we thought we’d shift our focus to you, instead of examining general worldwide trends and activity. Our Viewer Insights for the last 30 days takes an in-depth look into the activity of your competitors to see: what sector insights were viewed the most on the Business Sale Report website, which pages and industries appeared most popular, and the top businesses that piqued interest.

Most importantly, we’ll also try to explain exactly why.

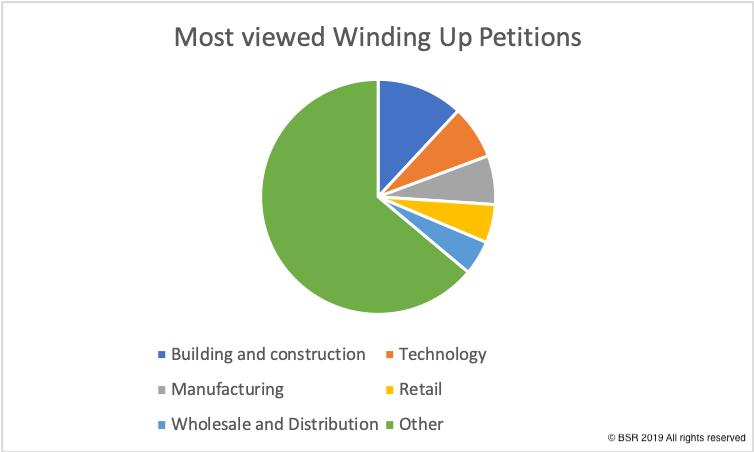

Winding-Up Petitions

A court order has been filed, and an insolvent business is being forced into compulsory termination to liquidate the company’s assets in order pay off its creditors: in this scenario, businesses are facing winding-up petitions.

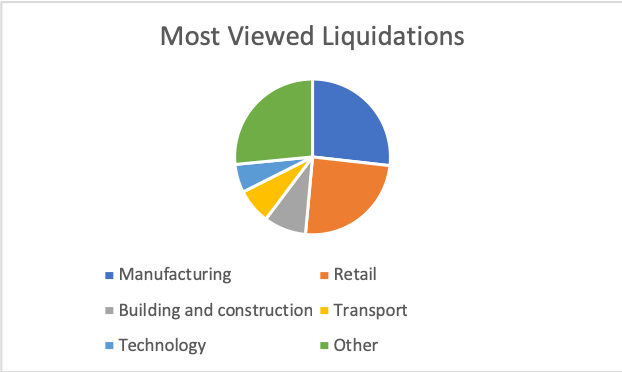

Liquidations

In the event of a liquidation, an insolvent business which cannot meet its financial obligations is brought to a close by distributing its assets to petitioners. The company’s creditors are paid off, and the business is officially struck of the Companies House list.

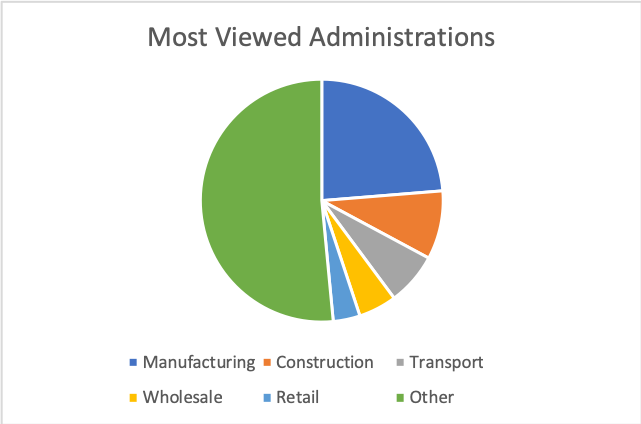

Administrations

Not a single day has gone by in the past month that a new business has not gone into administration. In this instance, the control of a company is handed over to a licensed insolvency practitioner to assess the business’s situation to leverage its assets in order to repay creditors, or finance a restructure to ensure profitability going forward.

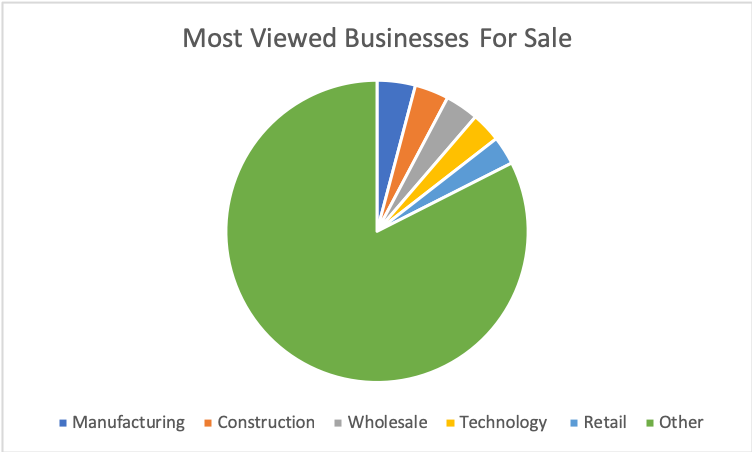

Businesses For Sale

Acquisitions are a great way to expand a business by growing its portfolio of services and therefore engulfing a larger share of the market. And so, this is perhaps why this section had the most diversity in terms of industry views! A whopping 82.46 per cent of all clicks fell into the Other category, meaning that interests were varied across the board.

The wholesale business has an established trading history and has built up a strong reputation and a loyal customer base. Business is drawn from a wide demographic of clients with a good spread across different business sectors.

This is a unique opportunity to acquire a company specialising in luxury performance cycle clothing, utilising the finest specialist fabrics and cutting-edge construction techniques.

A leading internet-based provider of customisable and curated beauty box services. Over the last decade, the business has evolved from a premier subscription service to a leading internet-based provider of highly attractive and rapidly expanding beau...

WEB-BASED

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.