The Private Companies Price Index (PCPI) and Private Equity Price Index (PEPI) research published by BDO for the first quarter of 2013 reveals growing trade buyer confidence.

The Results

At first glance the quarterly results appear gloomy. The total number of deals fell seven per cent from 538 in Q1 2012 to 501 in Q1 2013 – the greatest year-by-year quarterly decline since Q2 2011. On closer inspection, we see that trade purchases fell three per cent between Q1 2012 and Q1 2013, from 442 deals to 429; while private equity deals showed a steeper 25 per cent drop, from 96 to 72 – the lowest level since Q2 2011 and the sixth consecutive quarter of decline.

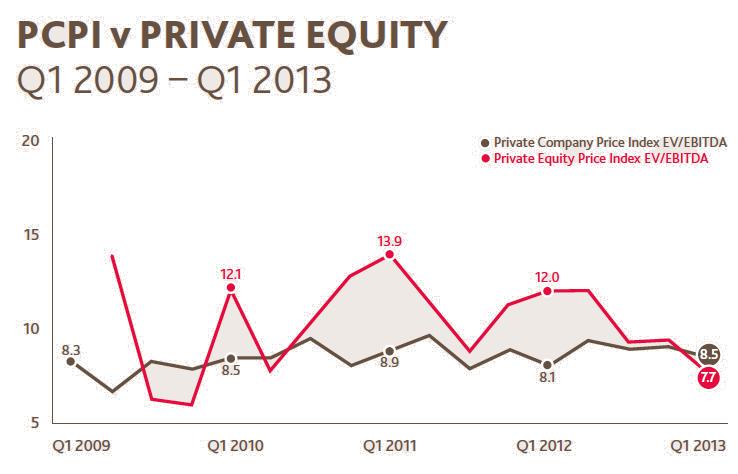

Despite these negative figures, it is encouraging to see that trade buyers are displaying greater confidence with the business purchases they do make, paying higher multiples to fund acquisitions. The PCPI EV/EBITDA ratio increased to 8.5 in the first quarter of 2013 from 8.1 in Q1 2012 for trade purchases, while the PEPI fell away by a third (36 per cent), from 12.0 in Q1 2012 to 7.7 in Q1 2013. This figure is the lowest result since Q3 2009.

Focus on trade purchases

Trade deals in the fast-growth area of technology are bringing in higher-than-average-premiums, a trend that was broadly expected of trade buyers this year. Cloud computing was predicted to be a particularly strong area for activity and, indeed, buyers have been very busy in this area.

Quindell Portfolio plc snapped up Isaas Technology, which offers cloud-based Software-as-a-Service, earlier this year, paying £1.34 million in cash. It is expected that the purchase will prove to be earnings enhancing in the current year.

In another example, Advanced Computer Software Group bought Computer Software Holdings for £110 million in cash. Advanced predicts that the merged group will rake in over £160 million in recurring and repeating sales.

Daisy Group has also been active in the marketplace with two recent large technology business transactions in the space of nine months, costing £28.5 million and £2.1 million respectively.

This heightened interest in technology business deals has generated a bounceback in overall M&A volumes. This still-developing sector is, after all, of interest to private equity firms as well.

Private equity buyers have also been active in the leisure business market, and yet while funds are available they have yet to match trade buyers’ confidence in paying premiums.

Peter Hemington, head of M&A at BDO, noted: “In the mid-market, we have seen a renewed level of interest by private equity in sectors such as leisure, particularly in the specialist side of the market such as high-end holidays. Meanwhile, advances in cloud computing have stimulated a real bounceback in technology M&A with both private equity and trade buyers keen to play a part.”

With technology businesses of special interest to all buyers, we can expect several more such transactions this year, as the technology sector continues to power ahead in innovation. This heightened acquisition confidence should begin to reflect on other sectors as well, at the least because technology is crucial to most businesses.

With the threat of a triple-dip recession avoided, the steady resilience of trade purchases over the past 12 months alludes to promising signs for the future.

Source: BDO Private Company Price Index

Represents an opportunity for an acquirer seeking a three surgery, predominantly private dentistry located in Pembrokeshire.

FREEHOLD

Predominately NHS dental surgery with scope for physical expansion, private growth and extended services.

FREEHOLD

Represents an opportunity for a dental practice acquirer seeking a seven surgery mixed dentistry operating since 1978.

FREEHOLD

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.