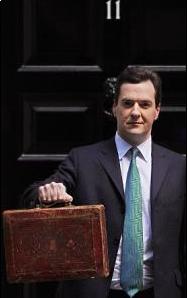

While a one per cent fall in the rate of corporation tax in George Osborne's announcement of the 2011 Budget had been expected by British business leaders, what had not been widely expected was the two per cent that Chancellor George Osborne actually did announce.

The Chancellor explained that, "It's all part of our ambition to make the UK the best place in Europe to start, finance and grow a business." So what do business operators in the UK actually think of the move?

The move received a resounding welcome from David Frost, director-general of the British Chambers of Commerce, who said that the lowering of the corporation tax was a demonstration of the government's dedication to making the UK an attractive place for people to be their own bosses.

"Reducing the main rate of corporation tax by 2pc is a clear signal that the UK is open for business," he stated. "We are pleased that the main rate will drop to 23pc over the next four years. This shows ministers really are listening to businesses."

In financial circles the move has been called "bold" and "unexpected" and Osborne has been lauded for his tangible efforts to bring Britain down from the position it currently holds as having the sixth highest corporation tax rate in Europe. Beyond the two per cent cut, which will come into effect from next month, the Chancellor also announced that the main rate will drop to 23 per cent by 2014.

It was his intention, he said, to give entrepreneurs in the UK the lowest rate of corporation tax out of all the powerful G7 industrialised nations, with the eventual 23 per cent rate standing at 16 per cent lower than America, 11 per cent lower than France and 7 per cent lower than Germany.

Combined with the doubling of Entrepreneurs’ Relief - to a lifetime limit of £10 million - the Budget has been hailed as a boon for people looking to invest in their own small businesses. The easing of the rules governing eligibility for the Venture Capital Trusts (VCT) and Enterprise Investment Scheme (EIS) will also make them open to a broader range of investors.

Writing in the Evening Standard, business commentator Simon Firth said, however, that now these incentives are in place, it is time to build up a robust network of so-called 'angel investors' who will actively put their money in to new British businesses.

"Angels do exist in Britain but are nowhere near as prevalent as they are in Silicon Valley where every second person seems to be one and angel culture has become a cut-throat market that's constantly shifting as investors try to out-do each other in access to the best start-ups in town," he said.

He said that the Budget's measures have certainly gone a significant way to improving Britain's allure to foreign angels, but that a network of home-grown angels is needed to take the Chancellor's measures and make them work for Britain's small businesses.

John Caillard, the Director-General of the CBI, agreed that the expansion of the Entrepreneurs’ relief would go some way to refocus on business with growth potential. He also singled out the increase in the SME research and development tax credit rate to an eventual level of 225 per cent as a measure that should make the UK a more attractive place to invest.

This is an opportunity to acquire the shares, business and/or assets of an electrophoretic and powder coating specialist located within the North East of England. Indicative proposals, supported by proof of funding, are accepted by no later than 4pm...

This unique holiday accommodation business offers distinctive, design-led stays on over 15 acres of private land, complete with exceptional amenities and a residential property. With a strong occupancy rate of over 90% and excellent guest reviews, it...

FREEHOLD

This exceptional opportunity allows you to acquire a leading UK business in pneumatic tube systems for healthcare, boasting exclusive distribution rights and strong client retention through multi-year service agreements.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.