Earlier this year, one of our M&A team had a conversation with a cashed-up serial entrepreneur who was contemplating a change of strategy that involved putting some of his money into Venture Capital funds. A couple of his buddies had done so a few years ago and struck a gold vein. He was sceptical, to be fair, but wondered what we thought about that strategy in the current climate?

The entrepreneur was told that we’re not investment advisers. But we could give him an idea of the general chances of success, given that he did not have a particular VC fund in mind nor had he even created a shortlist.

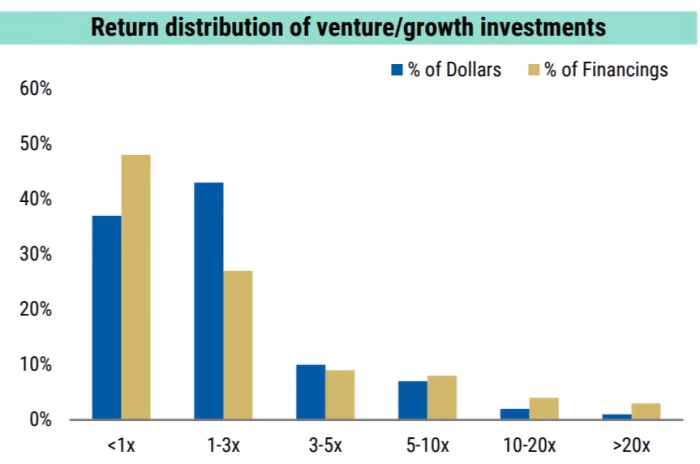

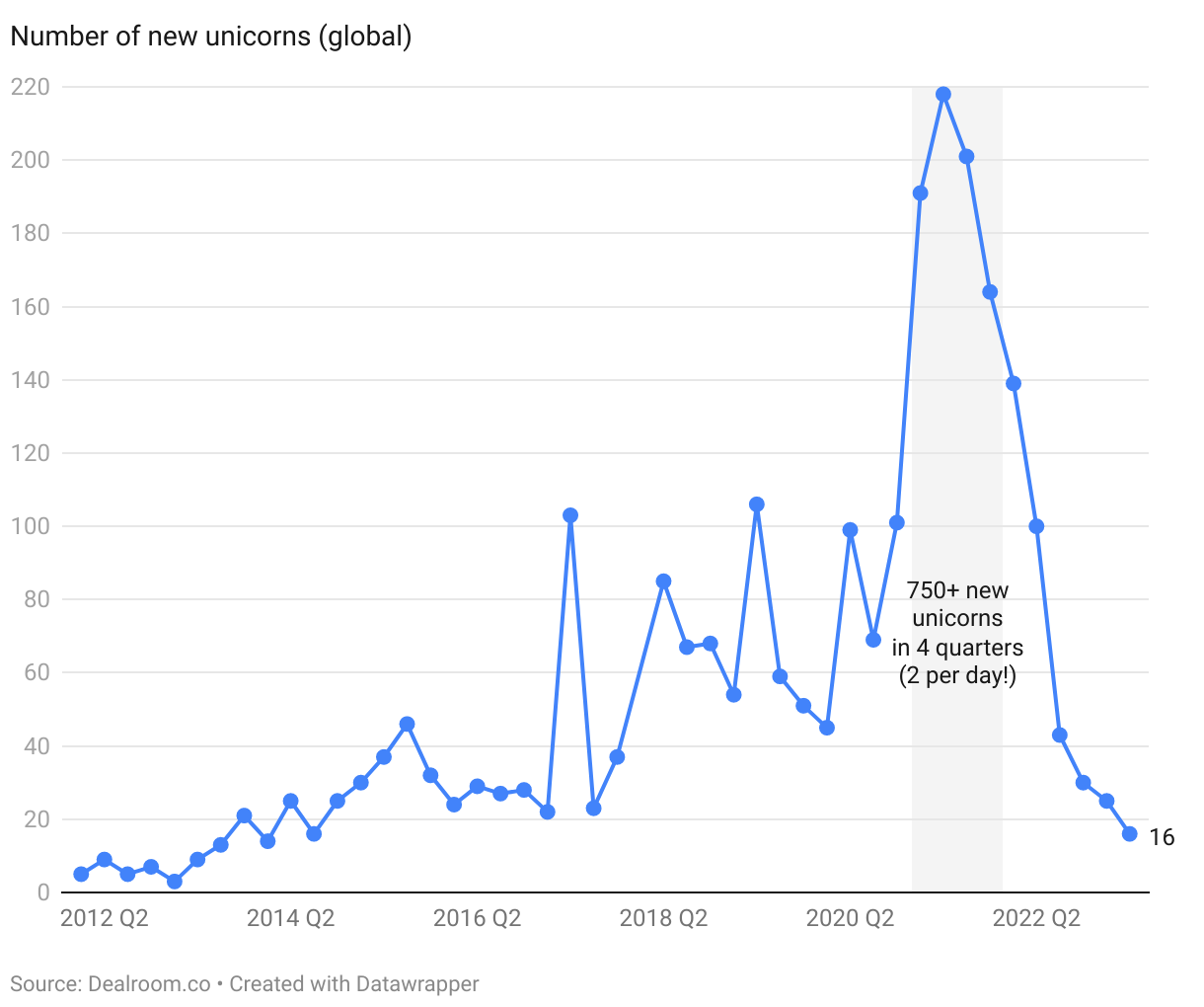

The big problem is that nearly all VC funds are neither high quality nor lucky. You have to treat money going into a VC fund as a moonshot investment. That is because they are inherently very high-risk. Many startups fail, and only a few provide significant returns. The hope is that one or two big winners will offset the losses from the majority of investments that don't pan out.

Most investors way overestimate the odds.

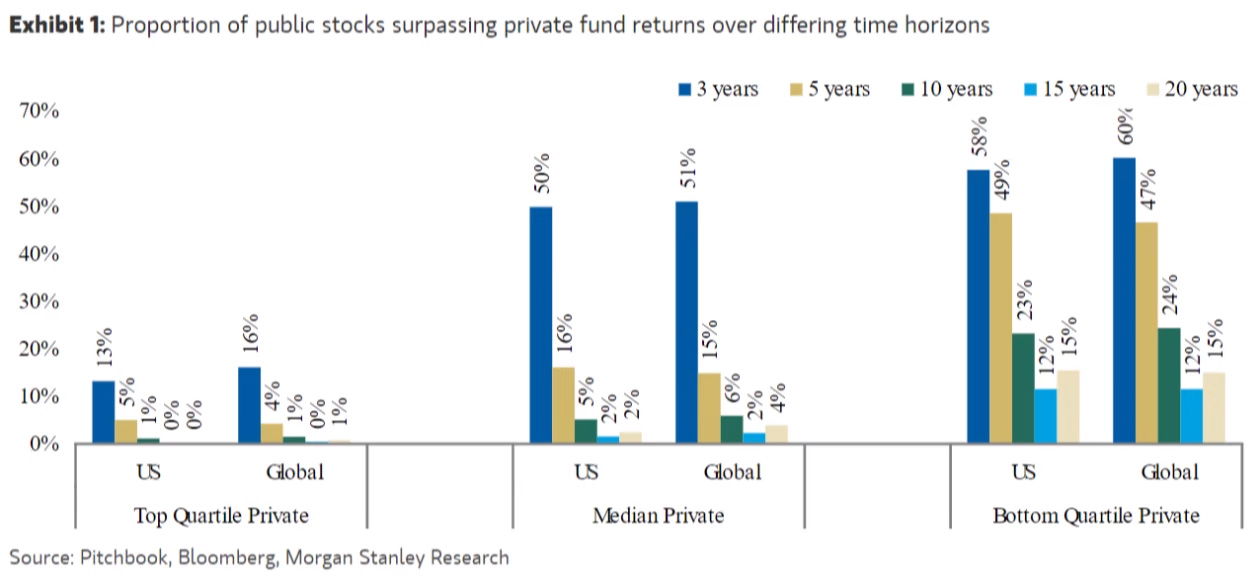

Now a report has come out from Edward Stanley and Matias Øvrum, equity analysts at Morgan Stanley, that looks at the returns from VC funds and stocks over the past 20 years. There’s a great summary of this report on FT.com.

They found that the average VC fund doesn’t reliably outperform the average stock.

In fact over half of all global VC funds (and 50% of US funds) have lost investors money, i.e. produced negative returns.

This is an opportunity to acquire the shares, business and/or assets of an electrophoretic and powder coating specialist located within the North East of England. Indicative proposals, supported by proof of funding, are accepted by no later than 4pm...

This unique holiday accommodation business offers distinctive, design-led stays on over 15 acres of private land, complete with exceptional amenities and a residential property. With a strong occupancy rate of over 90% and excellent guest reviews, it...

FREEHOLD

This exceptional opportunity allows you to acquire a leading UK business in pneumatic tube systems for healthcare, boasting exclusive distribution rights and strong client retention through multi-year service agreements.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.