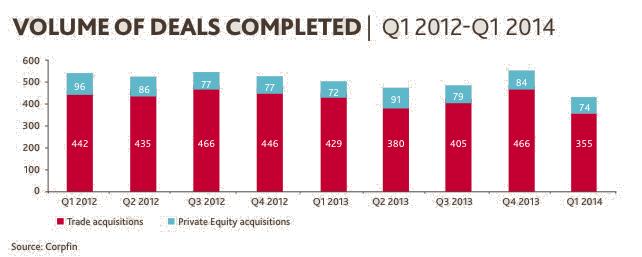

Despite predictions for continued growth, the volume of M&A deals in the first quarter of 2014 dropped in both private equity and trade markets.

BDO's latest PCPI/PEPI index showed that trade deals dropped by 24 per cent, down from 466 in the final quarter of 2013 to 355 in the first three months of this year. Similarly, private equity fell by 12 per cent, from 84 to 74.

The figures have come as something of a surprise to economists, who had expected last year's growth in the M&A market to continue on into the first quarter of this year. Political upheaval, in particular the ongoing dispute in Ukraine, has been held partly accountable, knocking investor confidence and changing the outlook.

But an increase in IPO activity has also contributed to the slow start for M&A deals this year as investment is directed away from private company deals and towards the stock market. However, political uncertainty looks likely to be the issue that most will focus on.

Tim Clarke, a partner with BDO, commented: “What we have witnessed is a great revival in the UK stock market, but along with the events in Eastern Europe, there has been a diversion of capital away from mergers and acquisitions.

“We do expect this to rebound towards the end of this year, however, as institutional allocations for new IPOs has become saturated, and companies once again turn to M&A to complete their deals.”

The matter of political uncertainty has been picked up by other business organisations, including the CBI. Sir Mike Rake, president of the organisation, warned at the CBI's annual dinner last month that political uncertainty is becoming a key consideration in risk strategies.

“Over the next 18 months, we face various challenges. Starting with European elections, then the Scottish referendum, the general election and then a possible EU referendum in 2017,” he said.

“As our economic situation has stabilised and now looks more promising, the focus of business concern has shifted towards these issues. And the uncertainty they engender is climbing up businesses’ risk registers, becoming a factor in investment decisions.”

Despite global conflicts and political upheaval casting doubts, investors have been reassured by the news that the upward trajectory of M&A deal volume is predicted to return by the end of the year. Confidence is also being drawn from the strengths emerging in certain sectors, with, for example, buyers finding more opportunities in the software and IT services sector. M&A volumes in this area have continued on the upwards trajectories they have maintained since as far back as 2009, with the EBITDA transaction multiple rising from just below 7 in 2009, to 8.75 today for IT services, and from 7.5 to 9.75 today for the software industry.

Commitments by both political and business leaders within the UK to secure the country's future in trade and investment have further reassured the market that the latest figures can be accounted for as a blip influenced by external changes, rather than a sign of a fundamental change in attitude.

In a recent research note, Standard Life Investments said they fully expected an expansion of M&A activity that will stretch well into 2015. The main drivers are a reduction in economic uncertainty, the availability of funds, and the continued pressure on businesses to keep costs down low.

Andrew Milligan, head of global strategy for Standard Life noted: “We believe that as cyclical forces start to take hold across the global economy, as business confidence improves and as financing becomes easier, so the pickup in M&A will continue”.

The sectors Milligan predicts will see sizeable deal flow include software, telecoms, internet companies, autos, media, beverages, real estate and financial.

Operating internationally, the company offers the development, hosting, and maintenance of electronic document management software. The business provides maintenance contracts, licences, installation, and training for its software.

This well-established business excels in resin floor installation and repairs, alongside additional services like stainless steel drainage installations, catering to diverse sectors including engineering, aerospace, and healthcare across South West E...

The companies supply an array of gases to suit various applications, with the group’s offering comprising all types of argon, oxygen, acetylene, nitrogen, carbon dioxide, refrigerant gases, propane and butane.

LEASEHOLD

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.