As the manufacturing sector continues its improvement in output performance, insolvency figures indicate that it bounced out of recession quicker and stronger than the rest of the economy as a whole – the first signal of its return to health.

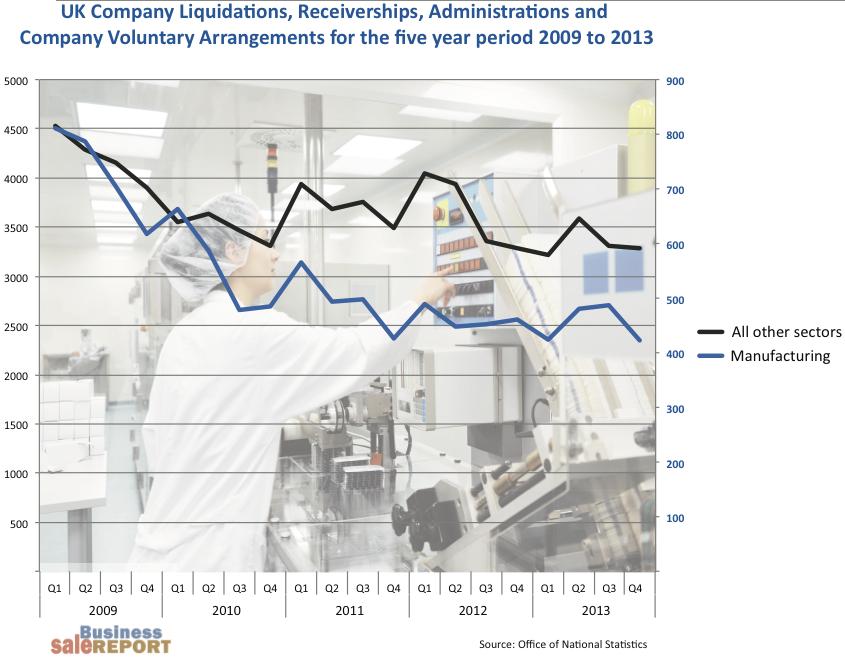

An analysis of all UK liquidations, receiverships and administration orders over a five-year period to the end of 2013 reveals a dramatic slowdown of manufacturing businesses going bust in 2009 and 2010 with a gradual and relatively steady decline through to the end of 2013.

By contrast, other sectors combined showed less of a reduction in business failures in 2009/10 (although still significant), followed by three years of ups and downs, particularly characterised by a sizeable increase in the first half of 2012.

The data, compiled from the Office of National Statistics, reveals that in the first half of 2009, there were 1,597 manufacturing company failures. In the last half of 2013 this had dropped to 911 failures, a decrease of 43 per cent. The combined total of company failures in other industry sectors in the first half of 2009 was 8,809, dropping to 6,595 by the second half of 2013, a reduction of 25 per cent.

Until the 70s, manufacturing still held a prominent position within the economy. But as international trade became increasingly accessible and developing economies in Asia established the facilities and labour force to deliver a cheaper service, British companies saw their services undermined in price and the economy tilted to focus on services-based businesses where it was still possible to provide a competitive service. Since 1970, manufacturing’s share of GDP has fallen from 32 per cent down to around 12 per cent today. The days of manufacturing textiles, clothing and low-tech commodities in high volumes are over - a phenomenon shared by other countries in the Western world as wages have risen.

This is often misinterpreted as a demise in British manufacturing, leading people to make absurd utterances like “Britain doesn’t produce anything any more!”

The reality is that UK manufacturing productivity has improved substantially since 1970, with total industrial output up over 40 per cent.

Certainly it’s been a rocky road with many casualties along the way, especially in 2008/2009, but it is clear that the industry is now on a marked upswing.

Indeed, analysts have been forced to take a fresh look and acknowledge that the sector has actually been outperforming the economy as a whole. In addition to the insolvency statistics, three sets of new data provide corroboration:

1. Towards the end of last year, the Markit/CIPS UK Manufacturing PMI demonstrated that an upturn within manufacturing was in full swing. The survey showed that new manufacturing orders reached a 20-year high in November 2013, while export orders also picked up. The index has since levelled from November’s high of 58.4, to the April reading of 57.3, but it continues to top the 50 mark and signals a level of growth that can now be maintained.

2. The latest Office for National Statistics figures found that the manufacturing sector’s output increased by 3.8 per cent between February 2013 and the same month this year. Chief economist at the manufacturers’ organisation, the EEF, Lee Hopley, attributed the increase to “a strong pick-up in the pharmaceuticals, transport and food sectors”. He dubbed the industry a “vital cog in the UK’s continuing recovery”.

CBI Deputy Director-General, Katja Hall, comments: “Overall, the manufacturing sector continues to perform well. Output growth is on an upward trend, with firms expecting an even stronger rise in the next three months”. “Inflationary pressures are under control, with firms now expecting only a slight rise in the selling prices of their goods.”

‘Smart Manufacturing’ sub-sectors that are really flourishing:

Clean Technologies - an emerging industry with long-term growth potential that is well suited to UK capabilities.

Aerospace & Defence - where the UK is a genuine world leader and the world’s second largest exporter. Sustained high levels of R&D have generated a strong knowledge base.

Automotive industry - this adds around £4.8bn of added value to the UK economy each year. Vehicle manufacturers in the UK export around 80% of production and car manufacturing volumes are on course to break all-time records by 2017.

Chemicals - Substantial value and expertise in the installed manufacturing base. The UK is one of the top ten global producers of chemicals and pharmaceuticals, directly employing over 160,000 people. The sector is the nation’s number one manufacturing exporter. 3. The CBI Industrial Trends Survey, announced at the end of May 2014, shows that activity in the UK manufacturing sector remains robust, with output expected to rise over the following quarter. The survey of 437 firms showed an increase in output at the same rate as April and March 2014, with total order books remaining well above the long-term average.

The sustained switch among manufacturing businesses from survival mode to a focus on the pursuit of growth has been facilitated by several factors fundamental to the sector’s operations.

Firstly, the fear that the sector was gradually moving towards being a ‘foreign affair’, completely dominated by large developing world manufacturers has been assuaged by the failure of overseas producers to deliver on quality: Asian and Indian manufacturers are no longer able to maintain their dramatically lower costs while delivering products that are equivalent to those made by domestic competitors.

Secondly, the tripling of import costs over the past five years mean that domestic companies are no longer seeing cost-effective results from sending manufacturing contracts abroad.

Thirdly, the UK manufacturing sector was hit hardest in the recession, with many businesses falling by the wayside. Britain was losing manufacturing jobs faster than its European partners and labour costs have been higher in the UK than in many other Eurozone countries, partly the result of a strong pound.

As has been documented in many studies, recession survivors often tend to come out hardier, leaner and rigorously cost-focused.

Why is that?

*They treat recessions as learning opportunities. They recognise that yesterday's thinking and strategies will not address today's challenges.

*They have built-in resilience into their operations and culture. This gives them extra capacity for coping with downturns and ‘black swan’ events.

* They have learnt to de-clutter excesses. This can include costs, activities, behaviours and projects. Anything that wastes time or financial resources.

* They are able to catalyze seemingly "negative" times into positive moves. They capitalise on changing dynamics in the marketplace. On the Business Sale Report website there are numerous examples of acquirers snapping up manufacturers that have fallen into administration.

* As Britain’s industrial workforce gets ever better trained and more productive, we seem to steadily require fewer of them. Manufacturing survivors see their employees as a scarce and indispensable resource.

Interestingly, many UK manufacturers, having adroitly downsized in the recession, are now finding themselves with capacity constraints.

These businesses have become natural targets for acquisitions and M&A activity in the sector has been building over the past twelve months. For their part, buyers have been waiting for the market to pick up and are now confident enough with the outlook to make purchases.

Robin Johnson, head of diversified industrials at Eversheds, says that his firm is seeing 12 to 15 potential buyers in some deals where the asset is seen as good quality.

‘Reflecting the strong outlook for the sector identified by the CBI, the feedback from our clients on the health of UK manufacturing is one of renewed optimism.’ Johnson added, ‘Also with consumer spending increasing, manufacturer order books for all areas of the supply chain are full.’ He noted that clients are still cautious about energy costs over the medium term, potential social costs and whether sufficient ROI can be achieved as capacity is increased.

‘For now, however, the sector is in rude health.’

This is a chance to acquire a longstanding and reputable manufacturer of modern concrete garages, with roots dating back to the 1940s.

This well-established haulage company in West Yorkshire offers a strategic location with easy access to major motorway links and a strong, loyal client base developed over 20 years.

This is a rare opportunity to acquire this thriving motor vehicle repair, MOT, and service centre. This professionally run business currently provides the majority of its services to private customers with a small amount of commercial work, which pro...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.