Buying a business is not like buying a house

Here’s what the majority of people do when they are seriously intent on buying a business: they treat the process like buying a house. They go to the estate agent, put in an offer and cross their fingers that the offer will be accepted.

This is an amateur approach and will usually involve the buyer deliberating for days, refining the offer before sending it over to the seller or broker and holding their breath.

What do you think the seasoned business owner is going to do? Send it straight back with a note saying “we’ve had offers like this or better than this – please improve on it.” The buyer thinks on it, goes to lenders to borrow more and sends in his/her revised offer.

Buying a business doesn’t have to be this way - when you have your heart set on buying a business, you need to look at the purchase more strategically:

Look to the assets of the business itself to raise the cash for the deposit (or to recoup your deposit payment). You can often borrow cash against the assets in the form of a secured business loan or asset financing. This allows you to raise cash to buy a business, or pay for a deposit, without using all your own money.

Use the business’ cash flow to make payments to whatever sources provided you with money for the deposit, and to pay the seller for the balance of the price that the seller financed.

Even if you do have your own cash to buy a business, it might not be the smartest move to pay the full agreed amount with it. Consider ways to leverage any money you do have access to. If you have £500,000 for example, instead of buying a business worth £500,000, consider using the £500,000 as a deposit for a much larger business. You then get to keep the profits from that much larger business. It’s all about financial leverage.

A quick aside: forget any notions about paying for a company without using any of your own cash - as is suggested by a number of 'experts' that regularly promote seminars or courses with the promise that you will discover the secrets to enable you to buy a company with no cash down. These courses produce a steady stream of 'one pound charlies'. No matter what financial engineering formulas you may be clutching, a deal like this seldom ever happens - and in those situations it does occur, there is often a very close pre-existing relationship in place between buyer and seller.

Make sure you have the right team in place to help you make a success of a deal before trying to put one together. At the very least this should include a lawyer with M&A experience and an accountant with industry knowledge. These experts can help you to structure a deal and ensure you are being realistic in your endeavours.

Familiarise yourself with sources of funds and how best to approach them. Hire a consultant to help with this side of things if you need to. There are even professional business buyer advocates available. Someone with expertise may be able to help you make your offer and/or business attractive to financiers and also to promote yourself as a great bet to sellers and sources of funding. Mistakes will be far more costly than the price of the expertise.

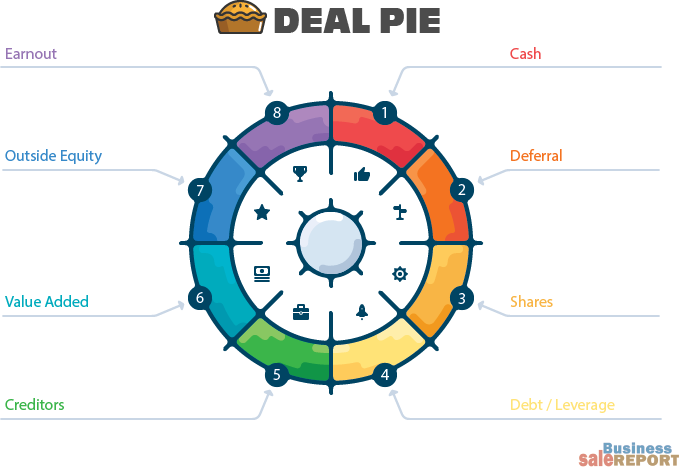

The Deal Pie

It should be possible to work alongside the seller to agree on how you can achieve the figure they want for their company using several components. Think structure rather than price.

This is a unique opportunity to acquire valuable intellectual property assets from a well-established wholesaler with many years of experience in the discount food and non-food sector in the Midlands.

This is an opportunity to acquire a long-established specialist bakery business, supplying major UK supermarkets and boasting a fully equipped production facility with a skilled workforce.

Discover the rare chance to acquire a specialist UK supplier of marine engines and generators, noted for their leadership in the used marine engine market and hard-to-find parts.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.