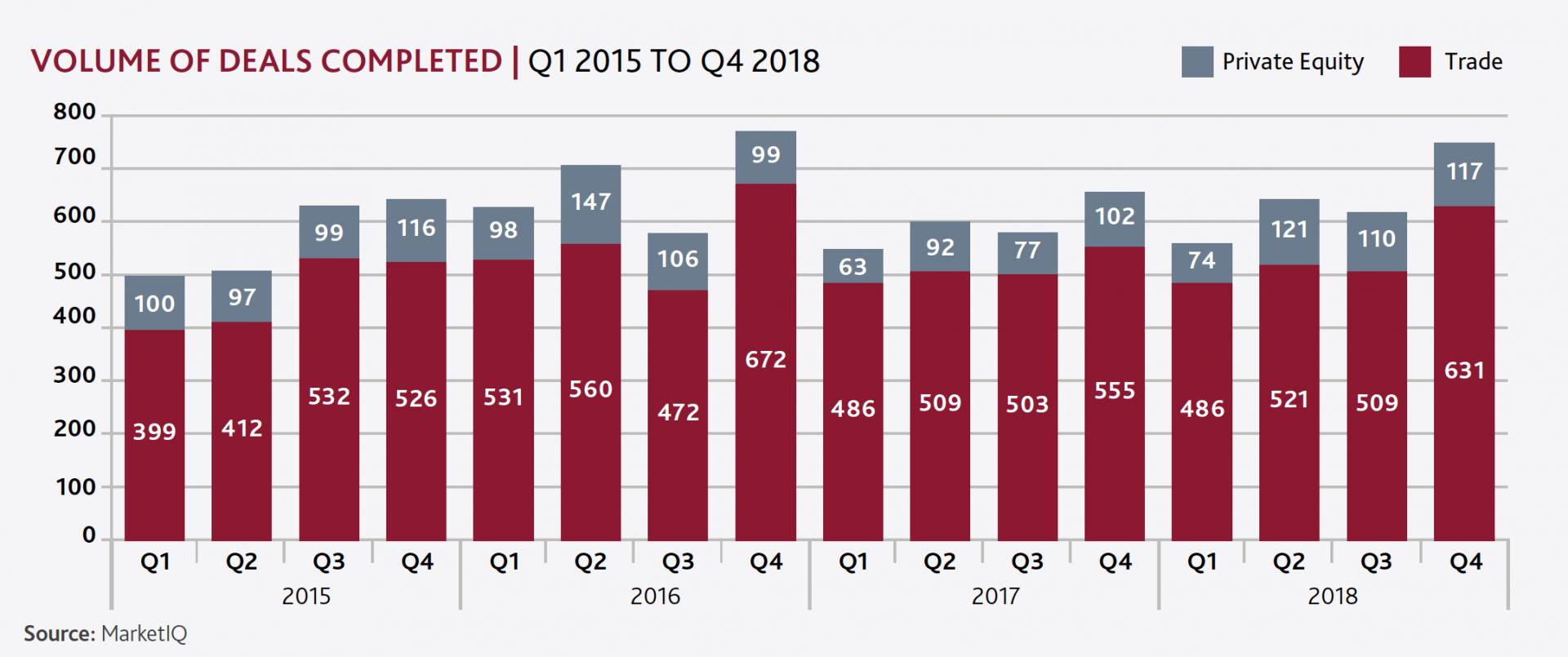

BDO’s Private Company Price Index/Private Equity Price Index (PCPI/PEPI) quarterly report for the fourth quarter of 2018 shows an increase in the value of deals being done towards the end of last year. In fact, the final quarter of 2018 was also the busiest of the year, with a 21 per cent increase in the number of deals done over the three-month period to 748. Over the year as a whole, some 2,569 deals were completed, representing an 8 per cent increase on 2017.

Deal Valuations

It’s comforting for anyone considering buying or selling a business this year to hear that dealmakers are still very much active. BDO stated: "The M&A market has remained resilient, with strong transaction volumes and values persisting through to the end of 2018."

In terms of deal valuations, private equity buyers are continuing to pay more for their acquisitions, in terms of EV/EBITDA multiples, than trade buyers. The average multiple paid by private equity buyers over the final quarter of 2018 stood at 12.1x. BDO explained that there continued to be ‘huge capital flows’ from private equity into the M&A market, which outstripped supply of businesses for sale and resulted in increased multiples being paid.

With regard to trade, buyers also paid the slightly increased multiples of an average of 10.4x EBITDA. Although private equity buyers tend to pay more for businesses than trade buyers, the likelihood of attracting a trade buyer is higher. Securing a private equity buyer when you are selling you business is more challenging than finding trade buyers as they expect a certain level of performance and a house that is very much in order - after all, they do have investors to answer to. Trade buyers tend to have a more strategic approach to acquisition and will be looking to find a prospect that allows them to cut out a competitor, grow their business or improve its portfolio of products, amongst other things.

Now, although the signs from this latest BDO report are positive with regards to the way the M&A market is holding up against the pressures from economic uncertainty and Brexit, BDO does point out that the ‘headwinds’ could be stronger for the first quarter of 2019.

The report states: "The latest BDO Business Trends report and decline in the FTSE all share index at the end of 2018, highlight stronger headwinds for M&A at the start of 2019." The FTSE all share index actually fell by 11.5x, which is the lowest level in four years. Concerns around the increasing trade disagreements between the US and China, the ongoing uncertainty around the Brexit situation, and the possibility of a no deal exit for the UK from the EU, have all been adding fuel to the fire of uncertainty. These concerns could be an indicator of tougher times ahead for the economy as a whole which, in turn, could impact the M&A market.

Other analysts echoed these concerns, with JPMorgan Chase & Co’s global head of M&A, Chris Ventresca, stating: “Stock market volatility was heavily prevalent in the final few months of the year. Any deals that were being discussed became harder for buyers and sellers to agree on the right price, causing several transactions to stall.”

Let’s watch this space and, in the meantime, take BDO’s advice: “Keep calm and carry on deal making.”

ABOUT THE PCPI

The PCPI incorporates Enterprise Value to EBITDA multiples as the method of valuation.

The PCPI/PEPI tracks the relationship between the Enterprise Value (EV) to Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) multiple (EV/EBITDA) paid by trade and private equity buyers when purchasing UK private companies.

It is important to note that the average deal value of transactions included in the PCPI over the past four years is £16 million and that multiples of smaller business sales get progressively lower as the transaction size drops.

Operating internationally, the company offers the development, hosting, and maintenance of electronic document management software. The business provides maintenance contracts, licences, installation, and training for its software.

This well-established business excels in resin floor installation and repairs, alongside additional services like stainless steel drainage installations, catering to diverse sectors including engineering, aerospace, and healthcare across South West E...

The companies supply an array of gases to suit various applications, with the group’s offering comprising all types of argon, oxygen, acetylene, nitrogen, carbon dioxide, refrigerant gases, propane and butane.

LEASEHOLD

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.