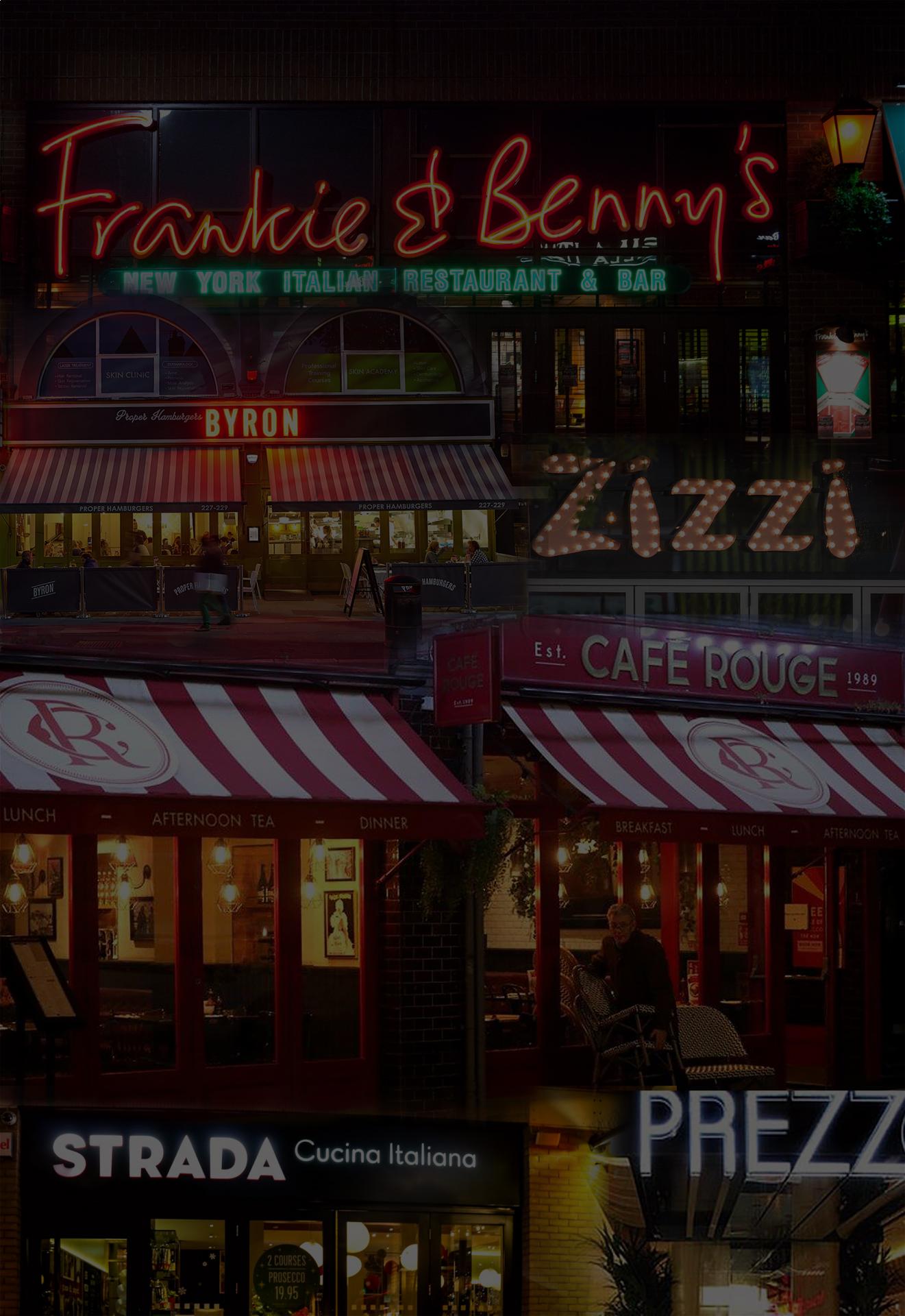

Three Hills Capital Partners put its Byron Burger brand into administration after failing to find a buyer in May, Cafe Rouge and Las Iguanas operator Casual Dining Group has been seeking a buyer, while The Restaurant Group announced the closures of 120 Frankie & Benny’s and Garfunkel’s restaurants. Azzurri Group, which owns ASK Italian and Zizzi pizza chains, has been bought out of administration for a modest sum by TowerBrook Capital Partners, which immediately announced the permanent closure of 75 locations. Private equity group Bridgepoint has lost its stake, having bought Azzuri for £250 million just five years ago.

This uncertainty has spread to other firms, including Gourmet Burger Kitchen, Pizza Express and Prezzo, all of whom have engaged restructuring advisers in recent weeks. TPG Capital, the private equity owners of Prezzo - already loss-making prior to COVD-19 -has engaged FRP Advisory to assess its options going forward, while GBK has turned to Deloitte after its parent company Famous Brands withdrew all financial support for the chain in April. Pizza Express, meanwhile, looks set to close around 75 locations following a Company Voluntary Arrangement (CVA).v Smaller chains are not faring any better. Zest Food, which operates the salad bar Tossed and Vital Ingredient chain, about 20 sites in all, collapsed into administration in July. It tried opening several stores in June, but with sales only running 5 per cent of normal, there was no ‘viable solution’.

Low sales, scrambling for cash and restructuring help in the midst of shaky consumer sentiment suggests that confidence in the sector is not high. COVID-19 appears to have pushed some already struggling operators over the edge. Meanwhile, the prospect of an undetermined period trading under the constrictions of social distancing rules could make the sector far less attractive to prospective investors, at least for the time being.

The government has acknowledged and attempted to mitigate some of the damage that lockdown has inflicted on businesses in the hospitality industries. This has most notably been seen with Rishi Sunak’s recent announcement of a temporary VAT cut on food, accommodation and attractions from 20 per cent to 5 per cent. But for many, this is akin to applying a band aid over a deeper wound.

So what does the future hold for the industry? Is the impact of COVID-19 merely accelerating a decline that was already well underway? Or does the sector have a future, characterised by resurgent consumer sentiment once the pandemic passes?

Most importantly, should COVID-19 make casual dining a less attractive sector for acquisitive parties? Or, will it create acquisition opportunities that could pay significant dividends further down the line?

A terminal decline?

Perhaps the worst-case scenario for the casual dining industry, and one that could be motivating many parent companies to sell up, is that coronavirus has merely been one final blow to a sector that was already on the way out.

This argument is borne out by the fact that the problems of many companies pre-date the pandemic. Frankie & Benny’s owner The Restaurant Group had announced plans to close around 88 outlets of its various chains as far back as September last year, a process that the pandemic merely served to expedite. Byron Burger, meanwhile, entered a CVA and closed 20 locations in 2017 prior to its acquisition by Three Hills Capital Partners, and filed post-tax losses of £47.2 million to the year ending June 24 2018.

There had also been high-profile casualties in the industry prior to the pandemic, such as Jamie’s Italian, which closed all but three of its then-25 locations in May 2019, and Strada. In 2018, another Italian chain, Carluccio’s closed 35 locations through a CVA, before collapsing into administration at the outset of lockdown in March, leading to the closure of a further 40 restaurants.

One theory that has been posited is that casual dining establishments are inextricably linked to the British high street and shopping centres, with their brand of easy, slightly more up-market fast food fitting nicely alongside a day spent out shopping. Casual dining restaurants are typically located in close proximity to, or in, shopping areas, generally require no booking and offer a quick, relatively cheap option when shopping.

With the rise of internet retail, then, and the well-documented decline in footfall on the UK’s high streets, casual dining operators are seemingly bound to suffer from fewer people being out shopping.

While some will no doubt have a loyal customer base and although many have been able to prop up their business through special offers such as vouchers and deals on apps, they are often not the establishments people turn to when seeking a “restaurant experience”, for instance for a special occasion. With lower numbers of people shopping at brick and mortar retail locations, casual dining seems doomed to take a hit.

Other restaurant chains have not been able to maintain the level of quality in order to justify their relatively expensive pricing. It is a simple fact of business that low quality does not encourage customer loyalty. Jamie’s Italian was beginning to rely on tourists and people passing by, while local custom waned with some posting negative reviews online. Chains have often had considerable pressure to chase profits above all else - sometimes this emanated from private equity owners, though it should not have been at the expense of customer experience.

Along with falling consumer confidence and disposable income as a result of factors such as Brexit and slow wage growth, there are also numerous other contributors to the sector’s struggles. Rising rent costs have seen many locations close and others turn to CVAs in order to stay open. The costs of labour and food have both risen, along with business rates, while the sector’s exponential growth over the last 20 years or so resulted in a crowded market.

According to consultancy firm CGA, rising costs and oversupply have prompted an overall decline in the sector following years of growth. CGA states that the UK has around 6,600 casual dining locations, a 3.1 per cent decline from 2019 and down 5.7 per cent from 2017.

This all lead to a challenging market environment for casual dining chains, even without the threat of a global pandemic and nationwide lockdown. When coronavirus struck, therefore, many were already in a vulnerable position and the easing of lockdown will not be the end of their problems.

Months of lockdown and a new way of doing things

The boost from government initiatives, such as CBILS, CLIBLS, the Coronavirus Job Retention Scheme and the recent VAT cut, will have done little more than keep those still in business from going under immediately and clearly hasn’t been enough for some.

As previously mentioned, COVID-19 has prompted multiple business administrations and sales processes, as well as restructurings at chains that were seemingly doing well just a few months ago. This precarious position, married with the difficulties facing the hospitality industry on the whole as they reopen following lockdown, suggests an even more difficult year or so ahead for casual restaurant chains.

The most obvious downside is the necessity for social distancing, which will see capacity at many locations drastically reduced. While rules for the reopening of restaurants have specified one-metre distancing, rather than two as feared, any distancing between tables is going to result in a reduction in the number of covers restaurants can provide, which will have a huge knock-on effect on turnover.

Kate Nicholls, Chief Executive of UKHospitality, estimates that one-metre distancing should reduce most restaurants to around 70 per cent capacity. As Nicholls points out, however, the difference between one-metre and two-metre distancing could be the difference between survival and demise. This is a sentiment echoed by Hospitality Professionals Association CEO Jane Pendlebury, who says that, while 2-metre distancing could reduce revenue to just 7 per cent, 1-metre would reduce it to around 45 per cent.

However, this is still a huge reduction in earnings that will doubtless leave many in trouble as government support begins to wind down and costs such as PAYE and rent rack up. Such costs, plus aforementioned increases in business rates, food costs and wages could spell a torrid period for casual restaurants while social distancing remains in place. This could very feasibly be the scenario for over a year, until a vaccine is rolled out.

Although the choice to wear masks in pubs, restaurants, cafes and bars has been left to individuals, operators fear that because it is now compulsory in shops, this will have a deterrent effect on offline shopping and, consequently, eating out. Some diners will naturally be worried about the potential of catching the virus in restaurants, particularly since the World Health Organisation publicised its concern about airborne transmission of coronavirus particles. Data recently released by the government shows that only 20 per cent of the population feel comfortable eating in restaurants.

This combination of a high cost base including a lack of rent breaks, the impact of months with zero revenue, the impact of social distancing on occupancy and the concern over catching the virus mean that a return to business as usual for operators in this sector looks to be some way off. As a result, we can expect to see more companies and restaurant groups enter administration as the economic impact of COVID-19 unfolds and, if the sector proves particularly unattractive to investors, insolvencies too.

But, while there is no doubt suffering ahead for some and hard work for all, are there signs that the casual dining sector isn’t ready to be written off yet and could even prove to be a shrewd investment?

Green shoots?

A possibility that exists across many sectors impacted by COVID-19 is that the pandemic will thin out an overly crowded marketplace and leave those that survive well-placed to benefit from reduced competition and resurgent consumer sentiment.

It might be the case that a less saturated casual dining sector, combined with a general public eager to get out and about after months in lockdown, could give the sector a long-overdue shot in the arm, for those that make it through of course.

This possibility might make the sector an extremely attractive prospect for acquisitive parties with the money, and the patience, to keep a business afloat until the good times return. With such distress in the sector at the moment, moreover, there will be no shortage of acquisition opportunities for those who are interested.

This is certainly the view taken by Alix Partners Managing Director Paul Hemming, who says: “The industry is likely to lose up to 25 per cent of its capacity over the next 12 to 18 months but those that survive, are properly funded and not carrying too much debt, will be in a position to thrive.” That view is also supported by industry adviser Simon Stedding who adds that it may also be good news for independent restaurants close to home.

Furthermore, there are positive signs that confidence in the UK casual dining industry hasn’t dried up and that some operators are still optimistic about the possibilities the sector holds.

For example, the world’s largest udon noodles and tempura restaurant chain, Marugame Udon, recently announced that it was planning a major expansion into Europe, with London as the base for this rollout.

Marugame Udon has over 1,000 locations worldwide, including over 800 in Japan and a further 250 across Asia, Russia and the USA. Under the stewardship of new CEO Keith Bird, the company is looking to expand to over 6,000 locations and is banking on locations in London to lead this charge.

This may appear a foolhardy plan to be ploughing ahead with, even in the pre-COVID economy, but, on the other hand, if something is going to reinvigorate the sector after the pandemic, it could be a disruptive new player.

Fundamentally, Marugame Udon’s plans represent a degree of confidence in the demand for casual, quality eating experience after coronavirus. Perhaps more so, it suggests a high degree of confidence in the appeal of a distinctive, well-known dining brand on the UK high street. All of these factors could provide encouragement for parties considering investing in the casual dining sector.

There is, without question, a tough year or so ahead for casual dining chains. Some will not survive the crisis, nor the subsequent recession, while others might scrape through in a drastically reduced state.

The key thing for any acquisitive parties considering swooping on such distressed companies is whether the sector is poised to bounce back, or whether coronavirus has merely speeded up a slow death that was already happening. Simply put, there will be many acquisition opportunities, but will they be worth taking?

For those looking to reap quick dividends on an investment in the food sector, something a bit more recession-proof than conventional restaurants may represent a better move. A recent report cited the proliferation of “chicken shops” in the wake of the 2008 financial crisis, as lower disposable income saw people turn to cheaper food options.

In the near-certain post-coronavirus recession, and in the age of social distancing, such quick, cheap takeout operators may be a very good investment.

There are enough signs to suggest that the casual dining sector is not quite done yet. With a slimmed-down marketplace and a resurgence in demand for shopping and eating out likely once the pandemic has fully passed, casual, value-for-money dining could still be an extremely worthwhile investment for acquisitive parties with the money and long-term mindset to weather the current crisis.

This market-leading vehicle rental company, based in the UK, boasts a strong reputation and long-standing partnerships with NHS Trusts, councils, and insurance companies, underpinned by a loyal customer base with around 80% return business.

This longstanding security solutions company offers a robust portfolio of services, including automatic doors and shutters, with a diverse and prestigious client base.

This established UK-based business, renowned for its spray painting and shotblasting expertise, boasts a remarkable 90% repeat business rate due to its highly specialised services and long-standing partnerships.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.