We’re going to explore what business sectors are likely to be most impacted by coronavirus and what opportunities might be created, including lower business valuations, asset sales of companies in administration and new market gaps.

We’ll also assess what the UK’s current state of lockdown will mean in the short term for the business market and what the lasting effects and trends might be in the aftermath of the current state.

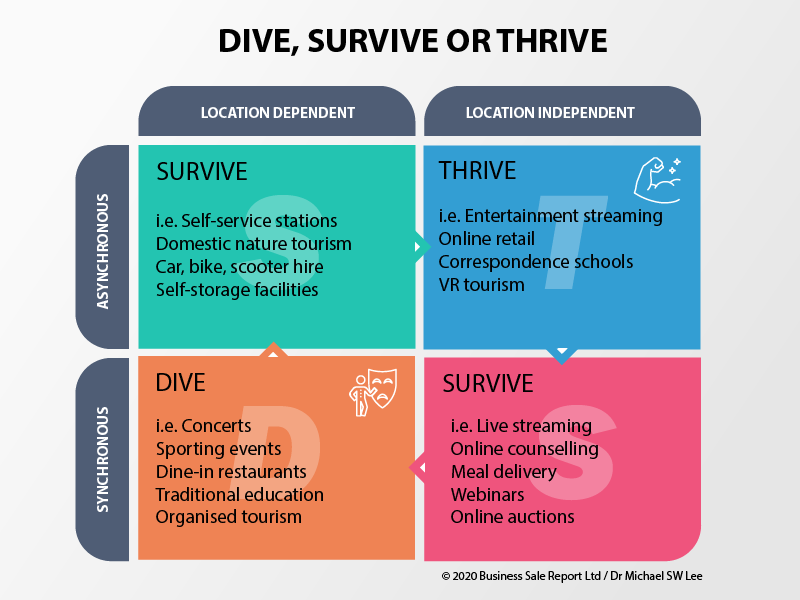

Dive, Survive or Thrive?

Discover a thriving industrial recruitment business with a strong reputation since 2017, known for its commitment to excellence and partnerships with prestigious blue-chip companies in the UK.

This long-established general engineering and fabrication business boasts a skilled workforce and a credible client base, serving diverse industries including oil and gas and renewable energy.

An enticing opportunity is available to acquire Project Burlington, a specialist distributor with a strong presence in the premium product sector, supported by a robust network of high-quality suppliers and loyal customer relationships.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.