At first glance, the latest data on the M&A market suggests some difficult times ahead for buyers of larger businesses with the current popularity of IPOs resulting in fewer business owners opting to sell, and a shortage of quality businesses available to buyers. Dig a bit deeper and it becomes clear that successful deals are still going through – buyers are simply having to hone in their search to make their purchase angle in the right sector.

Looking at BDO's second quarter Private Company Price Index (PCPI), it can't be denied that deal volumes among trade buyers are historically low. The Q2 report showed just 296 deals; down from 355 recorded in the first quarter and a 28 per cent drop on the same period in 2013. This change is the result of a combination of market conditions, driven in particular by a continued rise in IPOs.

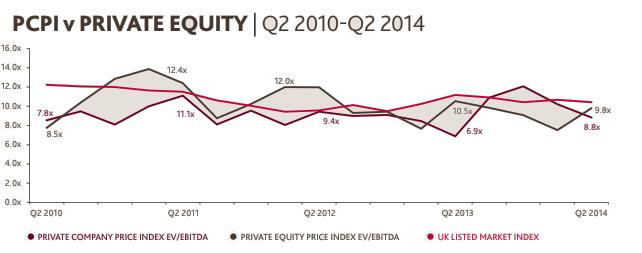

However, the drop in trade sale volumes has - to an extent at least - been bolstered by an improvement in the private equity market. While the PCPI showed a significant decline in volumes, the second quarter Private Equity Price Index (PEPI) showed an increase in trade volumes against the first quarter, with current market conditions prompting private funds to sell.

What's clear from both sides of the fence is that now is a good time to sell a business, with a shortage of sales from the private company market creating a lack of high calibre businesses overall and delivering a sellers' market. But what if you're looking to buy a business? Well, one option is to consider the distressed market. Although the number of distressed UK businesses is currently quite low, figures are forecast to increase should the Bank of England increase the base rate – a move that is looking increasingly likely as the August Monetary Policy Committee meeting saw the committee's unanimity dissolve with two policymakers voting in favour of raising the rate to 0.75 per cent. But if it's solvent businesses you're after, the solution to the shortage is to create a targeted and narrowed focus for your search.

For a larger selection of acquisition opportunities, all the signs point to the pharmaceutical, medical and biotech sectors as having some of the best bets for buyers. The sector bucked the trend in 2013 with deal volume remaining consistent; this year, it has gone one step further and deal volumes have risen significantly in the first and second quarters, with market predictions suggesting that this will continue further into 2014.

Moreover, the interconnected nature of these three sectors is creating some interesting deal opportunities for buyers who know where to look, as BDO notes: “When pharma deal values are higher, biotech deal values stay lower, and vice versa. This is driven by the fact that most biotech deals are driven by pharma acquisitions – so if pharma is too busy spending its cash on merging with or strategically partnering with other pharma companies, then biotech tends to be quieter with fewer, lower value deals.”

While this bodes well for those with a relevant niche sector interest, buyers with a broader purchase interest can also expect to hear some good news in the not so distant future. Reports indicate that although there is currently a long backlog of companies seeking to achieve an IPO listing, analysts are of the opinion that this is likely to change in the near future due to the uncertainty surrounding the 2015 general election. If these predictions prove true, sources indicate that companies are likely to return to trade sales as an alternative to IPOs increasing the options available to business buyers.

Operating internationally, the company offers the development, hosting, and maintenance of electronic document management software. The business provides maintenance contracts, licences, installation, and training for its software.

This well-established business excels in resin floor installation and repairs, alongside additional services like stainless steel drainage installations, catering to diverse sectors including engineering, aerospace, and healthcare across South West E...

The companies supply an array of gases to suit various applications, with the group’s offering comprising all types of argon, oxygen, acetylene, nitrogen, carbon dioxide, refrigerant gases, propane and butane.

LEASEHOLD

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.