Wed, 13 Mar 2013 | BUSINESS SALE

Maven Capital Partners has sold Homelux Division to a US company as it makes a partial exit from the Homelux Nenplas business.

The venture capital trust, private equity and alternative asset manager sold the firm to US business QEP Company.

The division was sold as a result of a complex demerger, which took place alongside a secondary buyout of Nenplas by Maven and the company's existing management team.

While the details of the transaction are complex, the result for investors has been simply a boost in profits. The acquisition took the group's turnover to almost £20 million and the partial exit has been in Maven's favour.

Mike Collis, portfolio manager at Maven, commented: “We are delighted to have achieved a profitable exit from Homelux for our investors.

“Although we are unable to disclose the deal size, we are very pleased with the returns generated by the exit and are looking forward to working with the remaining managers to replicate this success with the Nenplas business.”

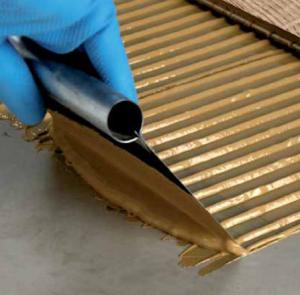

Homelux supplies tile accessories to the professional and DIY markets. It has a particular focus on marketing and merchandising of kitchen and bathroom products, with outlets across Europe and the US, as well as the UK.

____________________________________________________________________________

Related articles:

Now is the time to buy a business

Post merger integration

A lucrative organisation, with a solid international presence, excels in matching premier tech talent with top firms across a variety of specialisations such as data, analytics, and software engineering.

This is a unique opportunity to acquire a fully private dental practice in Lincolnshire, equipped with a range of specialisms and established associates.

LEASEHOLD

This opportunity features a flexible practice model in Nottinghamshire, suitable for either a principal or an associate to lead, catering to both private and plan-based clients.

LEASEHOLD

|

11

|

|

Apr

|

Environmental Essentials makes it four with Omega buy | BUSINESS SALE

BFG-backed Environmental Essentials has completed its fourth...

|

11

|

|

Apr

|

Irish logistics group Primeline buys Redditch peer Avon Freight | BUSINESS SALE

Irish logistics group Primeline has expanded its presence in...

|

11

|

|

Apr

|

Vortex Companies buys sewage and drainage peer McAllister | BUSINESS SALE

Texas-based Vortex Companies, a global providers of trenchle...

|

18

|

|

Mar

|

Elite KL undergoes MBO and changes name to Calatherm | MBO/MBI

A Staffordshire-based heating, ventilation, air conditioning...

|

14

|

|

Jun

|

Private equity firms launch acquisitive new wealth manager | BUSINESS NEWS

Private equity firms Maven Capital Partners and Ares Managem...

|

23

|

|

Jun

|

Just Trays undergoes a second MBO | MBO/MBI

The management at Yorkshire firm Just Trays (JT) is preparin...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.