Mon, 16 May 2022 | BUSINESS SALE

Manx Financial Group Plc has announced the acquisition of Payment Assist Limited in a deal that could potentially rise to £9 million. The deal will see Manx Financial Group subsidiary Manx Ventures acquire a 50.1 per cent stake in Payment Assist for an initial consideration of £4 million, while also agreeing an option to acquire the remaining 49.9 per cent stake for a consideration of up to £5 million.

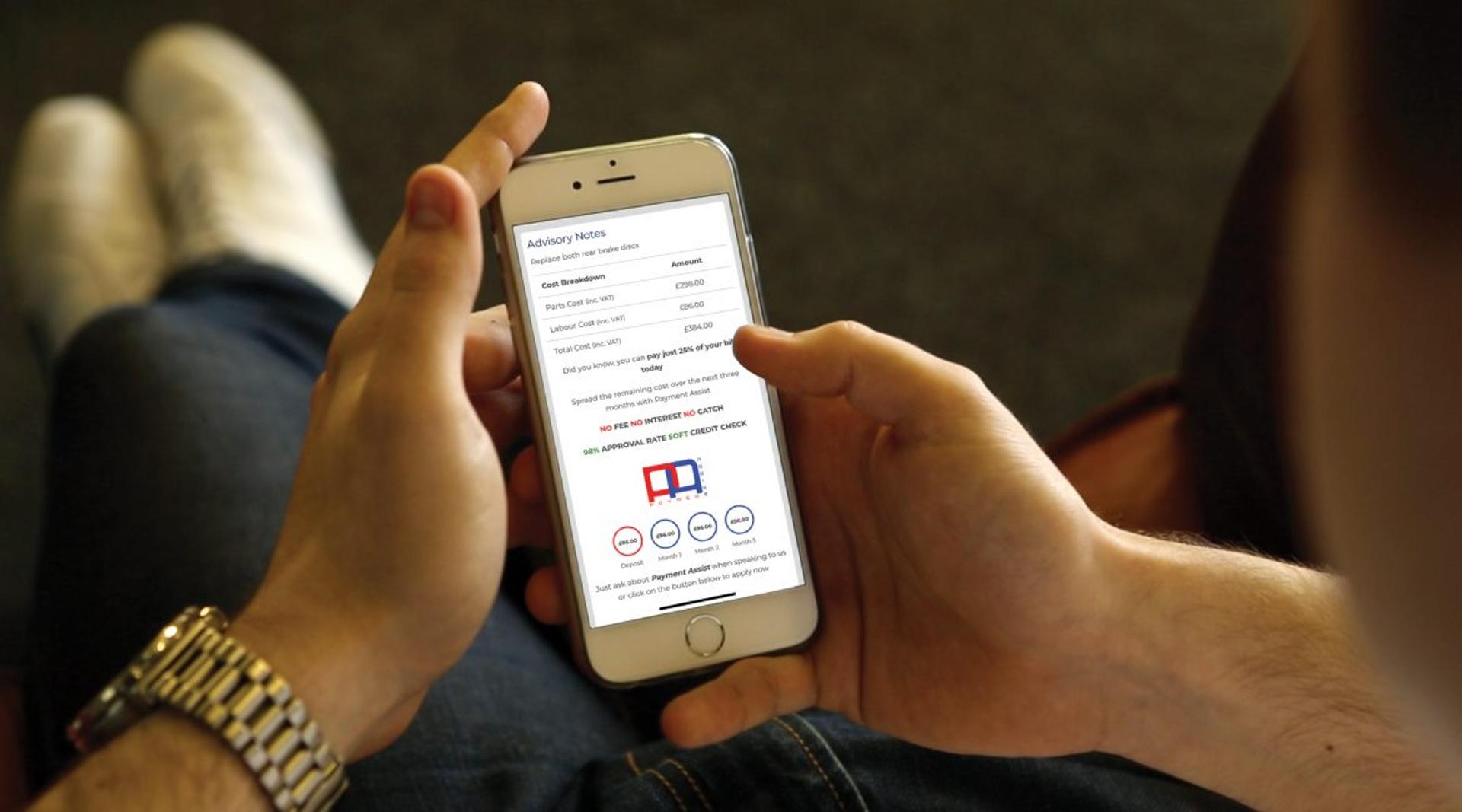

Announcing the acquisition, Manx Financial Group called Payment Assist “the UK’s leading automotive repair point-of-sale finance provider”. The company, founded in 2013, works with partners including Halfords, Formula O and National Tyres, providing a financial solution for customers who are not able to immediately pay for work performed on their vehicles and enabling garages to improve customer retention rates.

Payment Assist has diversified into markets including insured products and retail and has seen strong growth in recent years. The company's loan book stood at £21.3 million as of December 31 2021, up 72 per cent compared to 2019, while its EBITDA for the year ending December 31 2021 was £6.6 million, a 69 per cent increase on its 2019 figures. EBITDA for 2021 was £2.5 million, an increase of 108 per cent compared to 2019.

This financial growth has been driven by a significant increase in the company’s customer base over the past two years. In 2021, the company provided financial assistance to more than 170,000 customers, representing an increase of 43 per cent since 2019.

Following the completion of Manx Ventures’ acquisition of the initial majority stake, the two companies will enter into a joint venture agreement, providing Payment Assist with certain protections as minority shareholders. Through the subsequent option agreement, Manx Ventures will have the right to acquire the remaining stake for up to £5 million for a period of two years after the publication of Payment Assist’s audited accounts for the period ending December 31 2024.

The exercise option for the stake is based on an enterprise value of 2x Payment Assist’s average net profits for the three financial years ending December 31 2024. Should Payment Assist founders Neil Jeffery or Colin Ellard cease to be employed by the company during the option period, then Manx Ventures will have the option to bring forward the date on which it can exercise its option.

Manx Financial Group has worked with Payment Assist since 2015, with the buying firm’s wholly-owned subsidiary Conister Bank Ltd having provided the primary wholesale funding agreement that has helped to support Payment Assist’s growth over the past seven years.

Commenting on the sale, Manx Financial Group CEO Douglas Grant said: “The joint venture with Payment Assist continues our strategy of acquiring interests in high quality specialist lenders. We have witnessed first-hand the growth of Payment Assist over the last 7 years and the Board believes that there is potential for significant further growth.”

"The Acquisition, with no dilution to shareholders or external funding required, will position the Company to capitalise on what we expect to be a high margin and profitable business now and in the future. The option positions the Company to acquire the remaining 49.9% of Payment Assist at an attractive valuation if the business grows as the Company expects over the next three years.”

“We have started the process of engaging with the FCA to obtain their approval for the proposed change of control and will make an announcement to update the market once this is received.”

Payment Assist CEO Neil Jeffery added that he was “confident the partnership with Manx Ventures, and continued support from Conister Bank as we grow the business, will position Payment Assist to continue to be a leading point of sale lender in the UK and support our growth into new products and sectors.”

The acquisition is subject to the satisfaction of certain conditions, including FCA approval of the change of control.

Read about the factors driving M&A in the wider automotive sector.

Find businesses for sale here.

If you are looking for an exit, we can help!

An exciting opportunity to acquire a well-established independent financial advisor firm with £125m in funds under management in Wiltshire.

Although profitable, this business has quality personnel who can continue working, leading to a smoother transition post sale.

This firm represents a superb opportunity to establish a hub, with staff and offices already in place.

|

18

|

|

Apr

|

Household goods retailer Lakeland undergoes a management buyout | MBO/MBI

Windermere-based family-owned household goods retailer, Lake...

|

17

|

|

Apr

|

Manchester tech firm Wakelet bought out of administration | BUSINESS SALE

A Manchester technology company has been bought out of admin...

|

17

|

|

Apr

|

Nutrition company Science in Sports bought by investment firm for £82 million | BUSINESS SALE

Nutrition specialist Science in Sport (SiS) has agreed to be...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.