Mon, 27 Jan 2025 | BUSINESS SALE

A specialist civil engineering and construction building products distributor has been bought by the listed Wolseley Group.

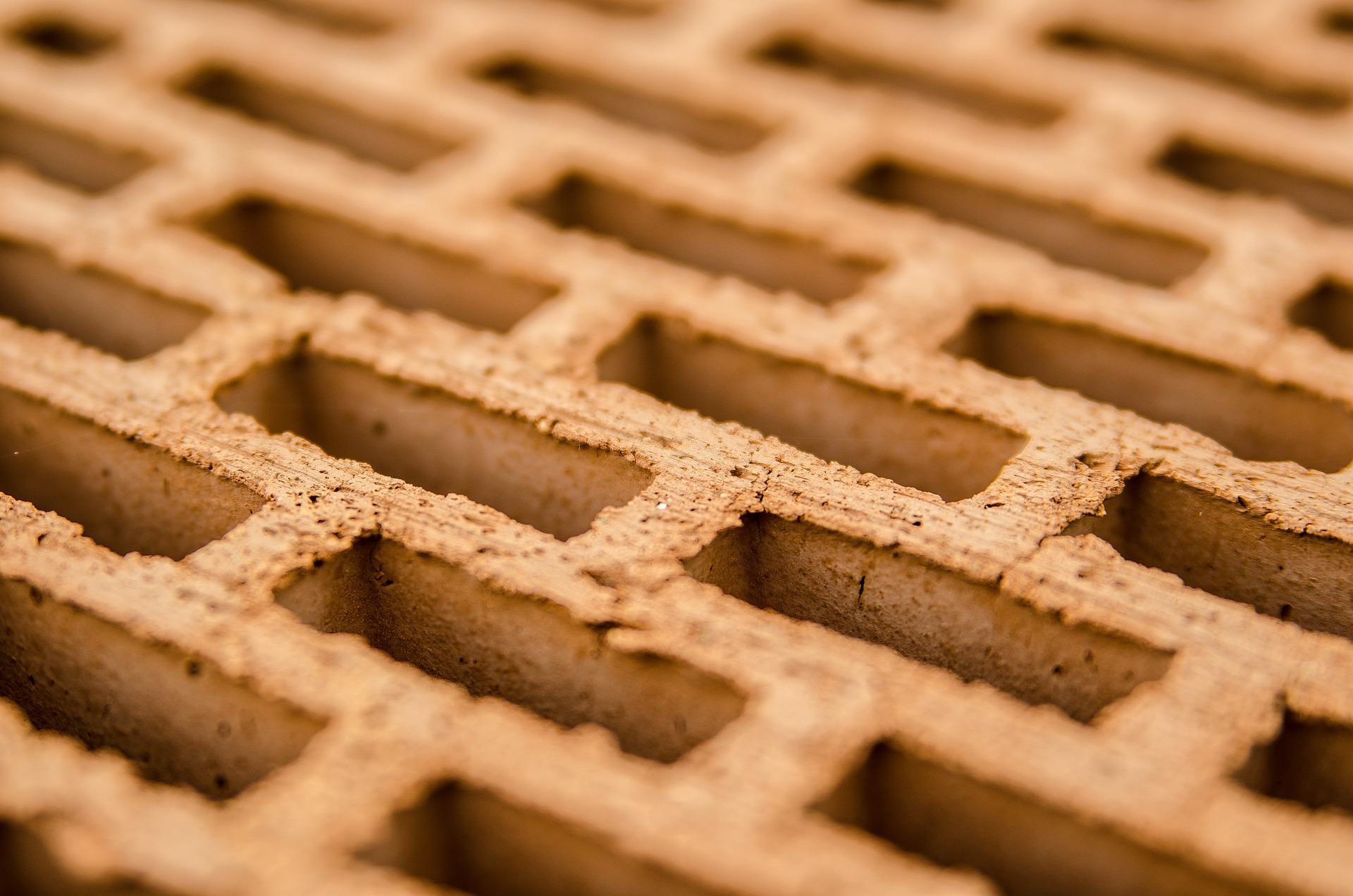

Blue Bay, which has branches in Cardiff, Luton, Warrington and Gateshead, distributes products such as gas protection, waterproofing, brickwork, insulation and ventilation. It offers services such as express delivery and runs its own fleet.

In addition, its Solco brand sells products such as sealing plugs and drainage membranes.

Despite some volatility in the construction sector in recent months, the company recently posted a turnover of £18.4 million for the year ending 31 March 2024, up from £17.5 million the previous year.

Pre-tax profit came in at £1.5 million, up from £1.4 million.

The company is led by a management team with substantial experience in the construction products sector. It will retain its brand identity following the acquisition, operating as usual with its around 50 employees and customers.

Simon Gray, chief executive at Wolseley Group, said: "We are delighted to add Blue Bay to our portfolio of specialist businesses. Its expertise and provision of market-leading products, combined with its exceptional reputation and strong relationships, will complement our existing businesses and help to ensure first-class service and availability of products is provided to our customers."

Nigel Howell, managing director of Blue Bay, said: "The synergies surrounding this acquisition will provide an unparalleled product offering to our sector, supported by industry-leading levels of customer service and technical support."

Gambit Corporate Finance acted as lead advisor to the shareholders of Blue Bay Building Products on its sale, for an undisclosed sum.

The Gambit team was led by Frank Holmes (partner), Sam Forman (partner) and Sean David (executive).

Holmes said: "As a market leader in its field, Blue Bay, with its renowned Solco brand and blue-chip civil engineering clients, is well-positioned for continued success. Its acquisition by Wolseley will only further strengthen the business."

Forman added: "It has been an absolute pleasure to support the shareholders at Blue Bay. We look forward to seeing this Welsh business carry on going from strength to strength, given the anticipated upturn in UK infrastructure investment."

Find out more about M&A sentiment in the UK in 2025

Fantastic opportunity to acquire a well-established and highly reputable construction business catering to high net worth clients across the South East of England. Known for its superior quality of workmanship and comprehensive service offerings, thi...

A well-established and experienced civil engineering subcontractor, with an experienced workforce, an active client base, and a healthy financial profile.

Opportunity to acquire a well-established construction business with a strong presence in the Midlands and both the North & South West of England, with nationwide operations.

|

03

|

|

Apr

|

Whitworths Food Group buys oils group KTC Edibles | BUSINESS SALE

Northamptonshire-based Whitworths Food Group is buying KTC E...

|

02

|

|

Apr

|

NVM exits travel tech firm Intuitive with Banyan Software deal | BUSINESS SALE

Banyan Software has bought a technology provider of end-to-e...

|

02

|

|

Apr

|

CheckFire Group buys long-standing partner PJ Fire | BUSINESS SALE

CheckFire Group, the South Wales-based fire safety equipment...

|

09

|

|

Dec

|

Wolseley targets electricity market with Jointing Technologies acquisition | BUSINESS SALE

Wolseley UK has acquired power cable specialist Jointing Tec...

|

04

|

|

Jan

|

Wolseley UK sold to private equity firm in £308m deal | BUSINESS SALE

UK-based heating and plumbing distribution company Wolseley ...

|

08

|

|

Dec

|

Leamington company closures put jobs at risk | ADMINISTRATION

A major Leamington business is facing hundreds of redundanci...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.