Tue, 14 Jan 2025 | BUSINESS SALE

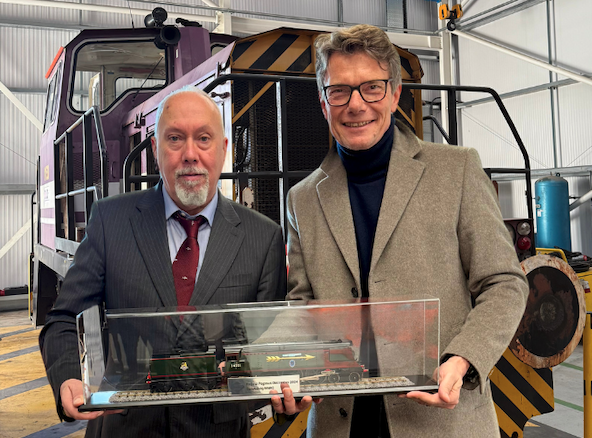

Swietelsky AG, one of the leading European construction companies in the rail infrastructure sector, has bought 100 per cent of the shares of UK-based Harry Needle Railroad Company Ltd (HNRC).

Founded in 1998, HNRC, with headquarters in Worksop and another facility in Barrow Hill, is one of the most renowned providers of maintenance, repair and rental services for locomotives and rail vehicles.

The company operates a state-of-the-art multi-purpose facility for rail services on a 14-hectare site in Worksop and employs more than 30 people. In the 2023/2024 financial year, HNRC achieved an operating performance of around €9 million (£7.5 million).

With the takeover, Swietelsky is expanding its portfolio in Great Britain to include key areas such as locomotive repairs, fleet management and track rental.

"This strategic step not only enables us to expand our market position in the area of Operate & Maintain contracts for Network Rail, but also to significantly increase our capacities for machine overhauls and future innovations such as the conversion of rail vehicles to European train protection systems," explained Peter Krammer, CEO of Swietelsky AG. "The synergies between our existing business areas and the competencies of HNRC offer an excellent basis for sustainable growth and the development of new business areas."

Main funder Frontier Development Capital will exit its investment in HNRC as a result of the deal.

HNRC was created by former paratrooper Harry Needle. He started out recovering spares from redundant rolling stock and went on to acquire a fleet of locomotives for hire. In 2019, with backing from FDC it acquired the derelict former rail depot in Worksop and invested £8 million to convert it into a complete operations centre.

Jack Glonek, investment director at FDC whose investment in Harry Needle came from its Rail Supply Growth Fund, said: “Harry Needle Railroad Company was already successful but with the acquisition of the Worksop site, it began a new era that saw it become a leader in its field. It has been a privilege working with Harry and his team, supporting them with multiple investments and watching the business go from strength to strength.”

Find out why more PE firms are looking to exit

This is a chance to acquire a longstanding and reputable manufacturer of modern concrete garages, with roots dating back to the 1940s.

This well-established haulage company in West Yorkshire offers a strategic location with easy access to major motorway links and a strong, loyal client base developed over 20 years.

This is a rare opportunity to acquire this thriving motor vehicle repair, MOT, and service centre. This professionally run business currently provides the majority of its services to private customers with a small amount of commercial work, which pro...

|

04

|

|

Apr

|

WPP buys data collaboration platform InfoSum | BUSINESS SALE

WPP has bought data collaboration platform InfoSum to boost ...

|

03

|

|

Apr

|

Cambrian Training Group chooses employee ownership | BUSINESS SALE

Cambrian Training Group is celebrating its 30th birthday by ...

|

03

|

|

Apr

|

Mobeus sells investment in Star Brands after boosting EBITDA by 15X | BUSINESS SALE

Equity investor Mobeus has sold its investment in Star Brand...

|

20

|

|

Nov

|

Watermark continues journey with MBO | MBO/MBI

Watermark, which helps turn airlines into ‘hotels in t...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.