Wed, 26 Jun 2024 | BUSINESS SALE

Nottingham-based chromatography provider Reach Separations has been acquired by Cardiff-headquartered CatSci in a deal supported by private equity manager Keensight Capital. The deal is described as a significant milestone for CatSci, an innovation partner for medicines development, as it continues to enhance its CMC (Chemistry, Manufacturing and Controls) offering.

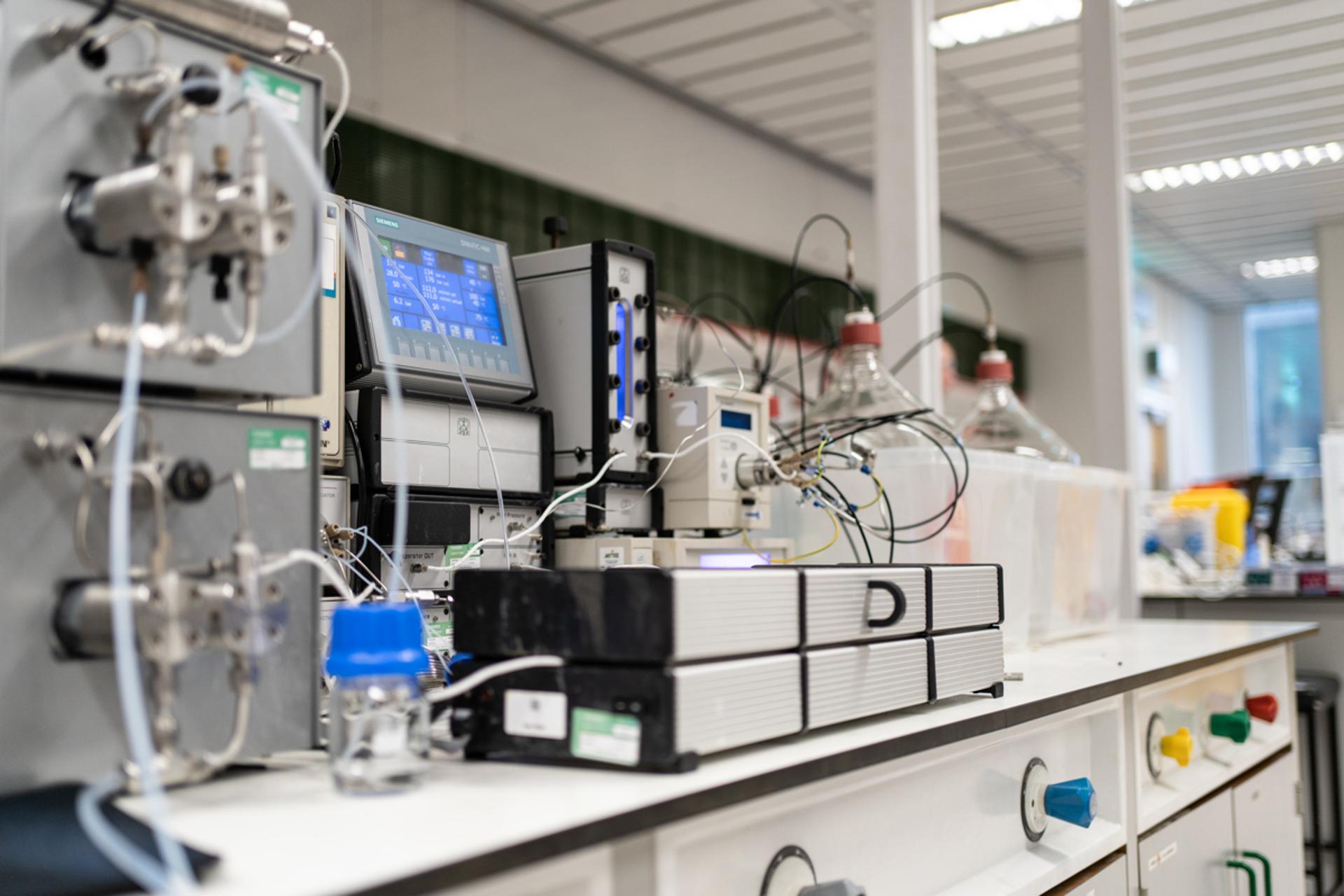

Reach Separations, which has laboratories in the UK and France, specialises in providing chromatography for the analysis and purification of chiral and achiral therapeutics. The acquisition is effective immediately and will enable CatSci to provide global customers with access to holistic chromatographic services that can be used throughout their processes, from discovery to manufacture.

CatSci Chief Executive Dr Ross Burn commented: “The need for solving complex analytical problems while meeting the ever-evolving regulatory demands is growing alongside the development of new modalities, such as oligonucleotides, TACs (Targeting Chimeras), and glues.”

"Joining forces with Reach gives our customers access to end-to-end coverage of the analytical development lifecycle, taking them from discovery through to GMP manufacture, and ultimately enabling them to help patients in need.’"

Reach Separations Business Development Director Peter Ridgway said that joining the CatSci group would “enhance and strengthen [the company’s] ability to deliver excellence in chromatography.”

He continued: “Integrating our technologies and expertise across the discovery and development landscape will provide a one-stop-shop for analysis and purification, giving the client a variety of options to progress the journey of their asset.”

Keensight Capital partner James Mitchell said that the firm would continue to support CatSci Group during their next phase of growth.

Mitchell added: "Having identified CatSci as a company with exceptional potential, unique positioning and strong expertise in the small molecule R&D, we believe that the addition of Reach’s differentiated offering, analytical capabilities and strong employee base will ensure that the combined company is well positioned for future growth in this space."

Discover how companies can attract private equity backing for their acquisitive growth plans

Represents an opportunity for an acquirer seeking a three surgery, predominantly private dentistry located in Pembrokeshire.

FREEHOLD

Predominately NHS dental surgery with scope for physical expansion, private growth and extended services.

FREEHOLD

Represents an opportunity for a dental practice acquirer seeking a seven surgery mixed dentistry operating since 1978.

FREEHOLD

|

18

|

|

Apr

|

Household goods retailer Lakeland undergoes a management buyout | MBO/MBI

Windermere-based family-owned household goods retailer, Lake...

|

17

|

|

Apr

|

Manchester tech firm Wakelet bought out of administration | BUSINESS SALE

A Manchester technology company has been bought out of admin...

|

17

|

|

Apr

|

Nutrition company Science in Sports bought by investment firm for £82 million | BUSINESS SALE

Nutrition specialist Science in Sport (SiS) has agreed to be...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.