Fri, 03 Jun 2022 | BUSINESS NEWS

The latest edition of BDO’s Private Company Price Report Index (PCPI) has shown that deal volumes and average deal values declined from Q4 2021 to Q1 2022. However, there is still cause for optimism among dealmakers, with figures remaining strong despite a high degree of uncertainty and disruption at the start of 2022.

The PCPI tracks acquisitions of UK private companies by trade buyers and also features BDO’s Private Equity Price Index (PEPI) which tracks acquisitions of private companies by private equity buyers. The latest report showed that trade acquisitions had average multiples of 10.7x in the first quarter (compared to 11.4x in the previous quarter), while private equity multiples stood at 11.8x (down from 12.1x).

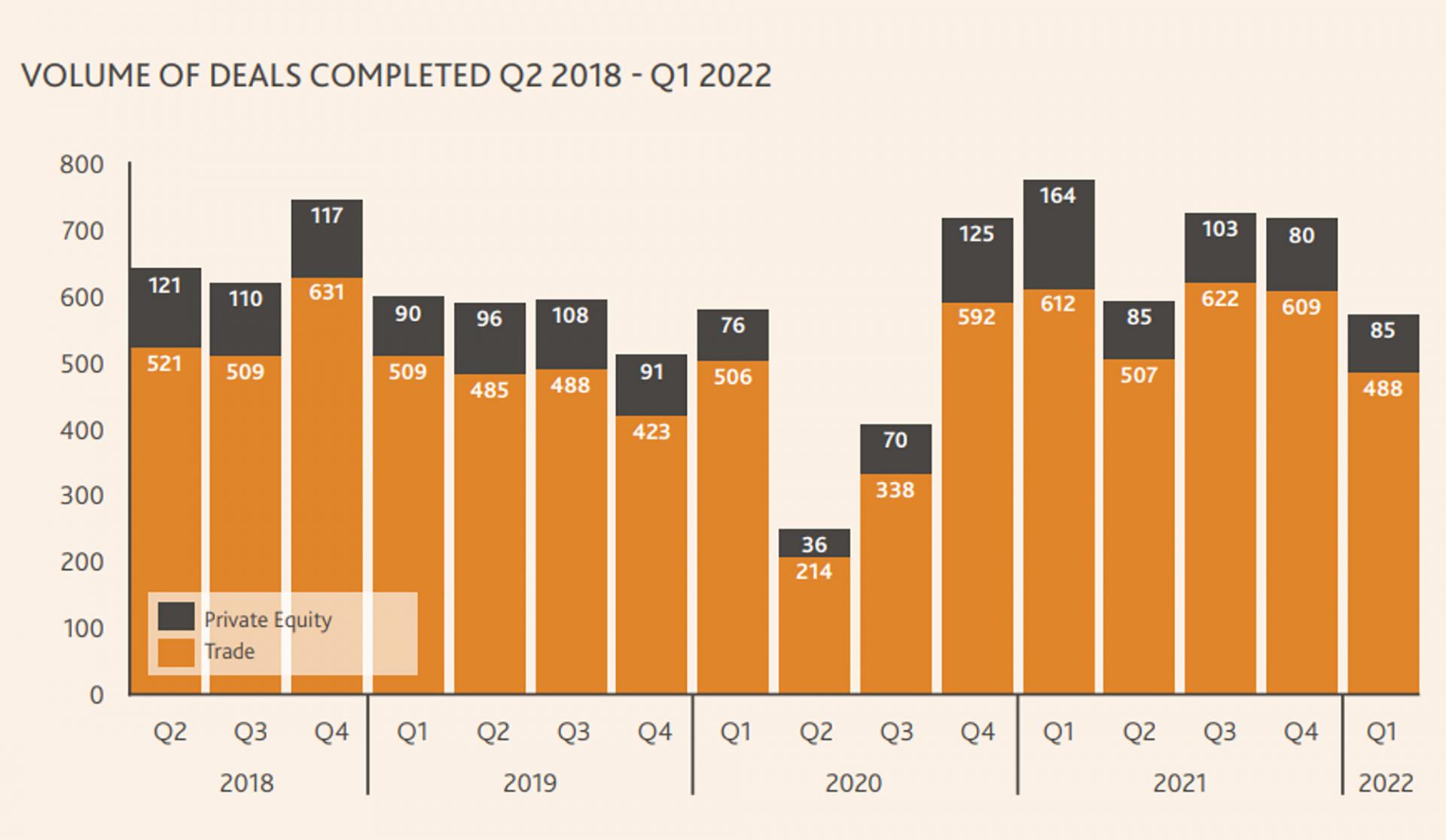

Overall, the PCPI tracked 573 acquisitions by trade and private equity buyers in the first quarter, down 16.8 per cent from 689 deals in Q4 2021. However, BDO has stated that this still demonstrates the strength of the M&A market, with deal volumes still remaining at pre-pandemic levels in Q1 despite global uncertainty, such as supply chain issues and the war in Ukraine.

There were more causes for optimism within the deal volume figures, with March recording the highest number of deals and private equity transactions actually rising slightly from 80 in Q4 2021 to 85 in Q1 2022. Overall, the decline seems to have been driven by a drop in trade activity, which BDO’s M&A Partner Roger Buckley called “not surprising”. According to Buckley, 2021’s high deal volumes represented a post-COVID “catch-up” in M&A activity.

Buckley commented: “It is not surprising to see a simmering down in volumes following the catch-up activity that took place last year. So far, indications are that the ‘new normal’ is looking very much like the old normal, despite considerable uncertainties across the economic and geo-political spectrum.”

“It is notable that March saw activity levels step up despite the invasion of Ukraine. UK business leaders have proven highly resilient and have cash to spend, meaning the outlook for M&A remains strong.”

To read more about how the PCPI works, as well as for further BSR analysis on what the figures mean and the prospects for dealmaking moving forward, read our insight on the latest report: M&A volumes in UK back to pre-pandemic levels.

Find businesses for sale here.

If you are looking for an exit, we can help!

Represents an opportunity for an acquirer seeking a three surgery, predominantly private dentistry located in Pembrokeshire.

FREEHOLD

Predominately NHS dental surgery with scope for physical expansion, private growth and extended services.

FREEHOLD

Represents an opportunity for a dental practice acquirer seeking a seven surgery mixed dentistry operating since 1978.

FREEHOLD

|

18

|

|

Apr

|

Household goods retailer Lakeland undergoes a management buyout | MBO/MBI

Windermere-based family-owned household goods retailer, Lake...

|

17

|

|

Apr

|

Manchester tech firm Wakelet bought out of administration | BUSINESS SALE

A Manchester technology company has been bought out of admin...

|

17

|

|

Apr

|

Nutrition company Science in Sports bought by investment firm for £82 million | BUSINESS SALE

Nutrition specialist Science in Sport (SiS) has agreed to be...

|

18

|

|

Apr

|

Household goods retailer Lakeland undergoes a management buyout | MBO/MBI

Windermere-based family-owned household goods retailer, Lake...

|

17

|

|

Apr

|

MGroup set to buy infrastructure peer Telent | BUSINESS SALE

Technology infrastructure giant Telent is set to be acquired...

|

17

|

|

Apr

|

Nutrition company Science in Sports bought by investment firm for £82 million | BUSINESS SALE

Nutrition specialist Science in Sport (SiS) has agreed to be...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.