Tue, 12 Mar 2024 | ADMINISTRATION

Since our last update, the following businesses have been confirmed as having fallen into administration. All dates indicate when the administration was posted by the Gazette and not necessarily the dates on which administrators were appointed.

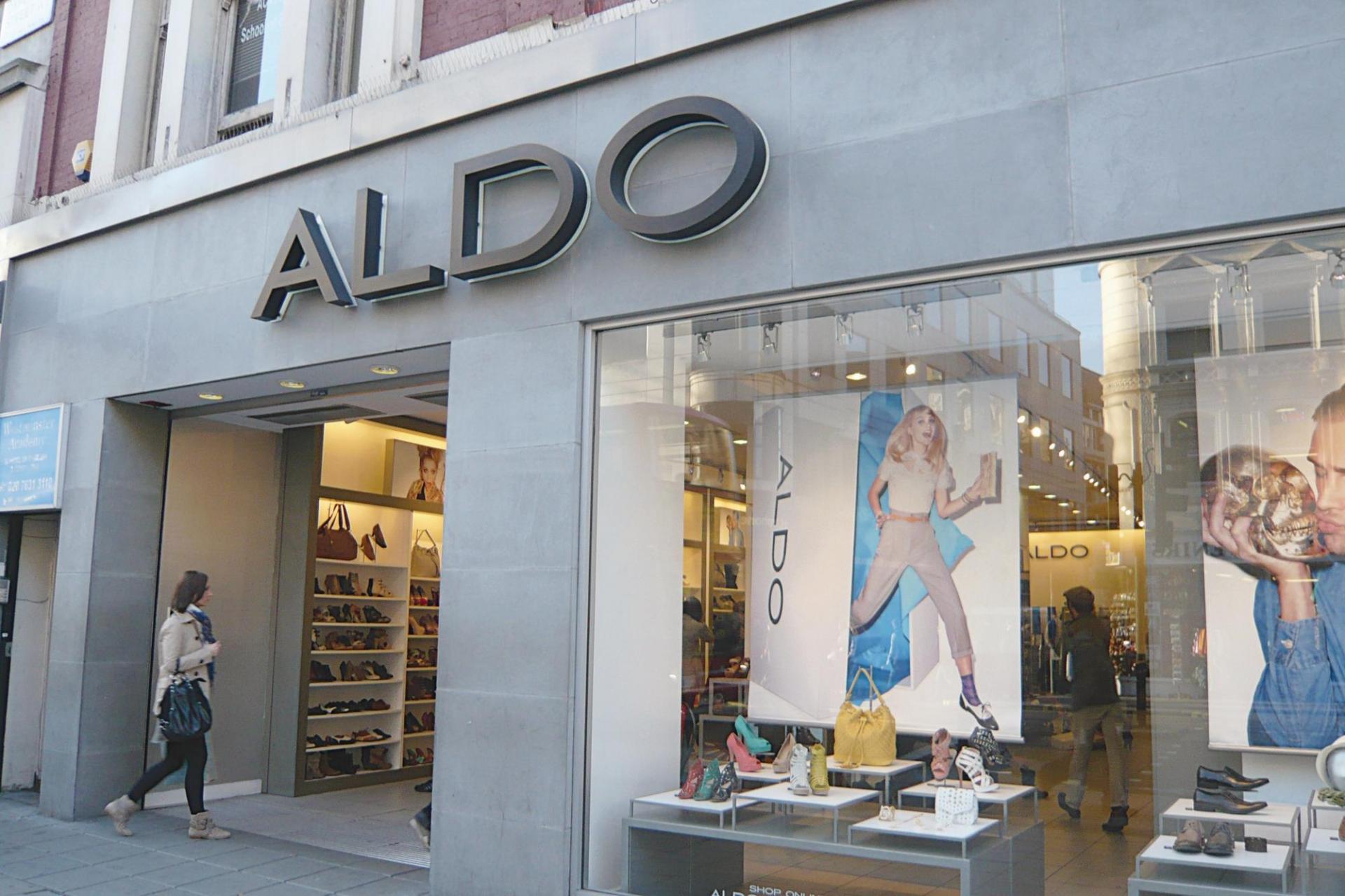

Retail Group UK 2020 Limited – March 5

Retail Group UK 2020 Limited, which trades as Aldo Shoes, is a high-street shoe retailer. The company fell into administration at the end of February, having filed a notice of intention (NOI) to appoint administrators earlier that month. Edward Avery-Gee and Daniel Richardson of CG&Co were subsequently appointed as joint administrators at the company.

Aldo Shoes is a long-standing high-street shoe retailer. The company fell into administration in September 2020 as a result of the COVID-19 pandemic and pre-existing profitability issues. The UK business and assets were subsequently acquired out of administration by Bushell Investment Group (BIG), whose chairman, Lee Bushell had founded Retail Group UK in May 2020.

The company’s most recent accounts cover the seven months to December 2021, during which time the group saw significant improvement, with turnover rising from just £2.6 million in the year to May 31 2021 to nearly £7.7 million, while pre-tax profits rose from £8,167 to £438,765. At the time, the company’s net assets were valued at £389,715.

Find out more about how the UK’s retail sector is being hit by rising insolvencies

Exclusive Luxury Lodges Limited – March 5

Exclusive Luxury Lodges Limited is a business operating holiday parks in Southern England. The company fell into administration in early February, with the Gazette confirming the appointment of James Slight and Peter Hart of PKF GM as joint administrators earlier this month.

The company operated five luxury parks in Devon, as well as one each in Berkshire, Suffolk and Gloucestershire. Its most recent accounts at Companies House cover the year ending December 31 2021, during which the company reported turnover of £2.1 million and posted a post-tax profit of £249,028.

However, this was down from turnover of £2.7 million and a post-tax profit of £319,171 during 2020, suggesting that the company had experienced a boom in trading as domestic holidays increased in popularity during the initial COVID-19 pandemic which had then tempered during 2021. At the time, its net assets were valued at £10.4 million.

Saietta Group Plc – March 6

Saietta Group Plc is an engineering firm that specialises in the design, development and supply of powertrains for electric vehicles, buses, scooters and marine applications. The AIM-listed company fell into administration earlier this month, along with its subsidiary Saietta Sunderland Plant Limited, with Lucy Winterborne and Daniel Hurd of Ernst & Young appointed as joint administrators.

The company was placed into administration following a strategic review, including formal sale process, conducted as a result of its deteriorating cash reserves. This process ultimately failed to secure a solvent solution, leading to the appointment of the joint administrators, who will now seek sale options for the business and assets of the companies.

Find out more about this administration here

Gordon Hotels Limited – March 6

Gordon Hotels Limited, which trades as The Mercure Bournemouth Queens Hotel and Spa in Bournemouth, fell into administration earlier this month, with Philip Dakin and Janet Burt of Kroll Advisory appointed as joint administrators.

The hotel will continue trading as normal while the joint administrators seek to find a purchaser for the business. In its accounts for the year to December 31 2021, its fixed assets were valued at £9.9 million and current assets at just under £338,000, with net assets amounting to £2.2 million.

The Asset Exchange Limited – March 6

The Asset Exchange Limited, which trades as The Car Loan Centre, Cash4Declines and Yes Car Credit, is a company that sells used cars and provides finance for car purchases to customers who normally find it difficult to obtain such finance.

The company fell into administration at the end of February, with the appointment of Ian Corfield, Geoff Rowley and Glyn Mummery of FRP Advisory as joint administrators confirmed by the Gazette the following month.

In the year ending December 31 2022, the company reported turnover of £14.9 million, up from £13.5 million a year earlier, and post-tax profits of £412,372, up from £367,535 in 2021. At the time, its net assets were valued at £1.4 million.

Inkthreadable Limited – March 7

Inkthreadable Limited, a custom printing business based in Blackburn, fell into administration late in February, with the appointment of Mark Colman and Megan Singleton of Leonard Curtis as joint administrators confirmed earlier this month.

In its accounts for the year to December 31 2022, the company’s fixed assets were valued at slightly over £1 million and current assets at £439,567. At the time, the company’s net liabilities amounted to slightly over £420,000.

Chappell & Dix Limited – March 7

Chappell & Dix Limited is a Cotswold building and carpentry business that has been trading since the 1970s. The company fell into administration earlier this month, saying it had been unable to overcome the severity of the current economic downturn, so soon after the global pandemic and the legacy problems that this caused the company.”

Neil Vinnicombe and Paul Wood of Begbies Traynor were appointed as joint administrators, with 60 jobs lost upon the company entering administration. In the company’s accounts for the year to June 30 2022, fixed assets were valued at £214,406 and current assets at £2.28 million. However, debts stood at more than £2.3 million, with net assets amounting to £166,790.

CLC Car Sales (North West) Limited and CLC Car Sales (South East) Limited – March 8

CLC Car Sales (North West) Limited and CLC Car Sales (South East) Limited are a pair of used car sales businesses, headquartered in Manchester and Essex, respectively, with a principal trading address in Basildon. The companies fell into administration at the end of February, with the Gazette confirming the appointment of Glyn Mummery, Geoff Rowley and Ian Corfield of FRP Advisory as joint administrators to both firms on March 8.

In the year to December 31 2022, CLC Car Sales (North West) reported turnover of close to £5.6 million, up from £4.8 million a year earlier, but fell from a £187,732 pre-tax profit to a loss of £207,040. At the time, the company’s total assets were valued at just under £9 million, but debts stood at close to £8.7 million, leaving net assets at £254,361.

During the same period, CLC Car Sales (South East) reported turnover of £4.9 million, up from £4.6 million a year earlier, and cut its post-tax losses from £4.5 million to £1.4 million. At the time, its net assets amounted to £59,615.

Find out more about the UK’s used car market

Anna Valley Limited – March 11

Anna Valley Limited, a supplier of audiovisual equipment to the corporate and broadcast markets, fell into administration earlier this month, with Ben Wiles and Geoff Bouchier of Kroll Advisory appointed as joint administrators.

In the company’s most recent accounts at Companies House, covering the year ending October 31 2021, its turnover rebounded to £12.1 million from just under £9.1 million a year earlier, while it reported a post-tax profit of just over £1 million, compared to a £105,703 loss the previous year. At the time its total equity stood at close to £7.5 million.

Radiant Solar Limited – March 12

Radiant Solar Limited, a company that constructs large-scale photovoltaic plants, fell into administration earlier this month, with Michael Sander and Steven Illes of MacIntyre Hudson appointed as joint administrators.

In the company’s accounts for the year to October 31 2022, its total assets were valued at around £2.9 million. However, the company’s debts at the time left it with net liabilities of more than £390,000.

UK Salads Limited – March 12

UK Salads Limited, a producer and supplier of salad items to UK retailers, fell into administration at the end of last month following a period of challenging trading. The company, which supplies UK supermarkets, had been hit by rising energy, labour and transportation costs, as well as supply chain issues and labour shortages.

Alastair Massey and Glyn Mummery of FRP Advisory were appointed as joint administrators and said they were “exploring interest from a number of parties.” In its accounts to October 31 2022, the company reported turnover of nearly £69.2 million, up from £51.1 million a year earlier, but saw its net profits fall from £854,177 in 2021 to £467,578. At the time, its net assets were valued at £10.3 million.

Find out more about this administration

MatchesFashion Limited – March 12

MatchesFashion Limited, a fashion brand that operated a major e-commerce business, as well as three physical stores in London, fell into administration earlier this month, less than three months after being acquired by retail giant Frasers Group.

According to Frasers, the company "consistently missed its business plan targets and, notwithstanding support from the group, has continued to make material losses". Julian Heathcote and Ben Dymant of Teneo Financial Advisory were subsequently appointed as joint administrators.

The company reported operating losses of £67.2 million in the year to January 31 2023, compared to a £37.5 million loss a year earlier. Its EBITDA losses, meanwhile, widened from £25 million in 2022 to £33.7 million. At the time, its gross assets were valued at around £170 million.

Find out more about MatchesFashion’s collapse

Represents an opportunity for an acquirer seeking a three surgery, predominantly private dentistry located in Pembrokeshire.

FREEHOLD

Predominately NHS dental surgery with scope for physical expansion, private growth and extended services.

FREEHOLD

Represents an opportunity for a dental practice acquirer seeking a seven surgery mixed dentistry operating since 1978.

FREEHOLD

|

18

|

|

Apr

|

Household goods retailer Lakeland undergoes a management buyout | MBO/MBI

Windermere-based family-owned household goods retailer, Lake...

|

17

|

|

Apr

|

Manchester tech firm Wakelet bought out of administration | BUSINESS SALE

A Manchester technology company has been bought out of admin...

|

17

|

|

Apr

|

Nutrition company Science in Sports bought by investment firm for £82 million | BUSINESS SALE

Nutrition specialist Science in Sport (SiS) has agreed to be...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.