Tue, 06 Aug 2019 | ADMINISTRATION

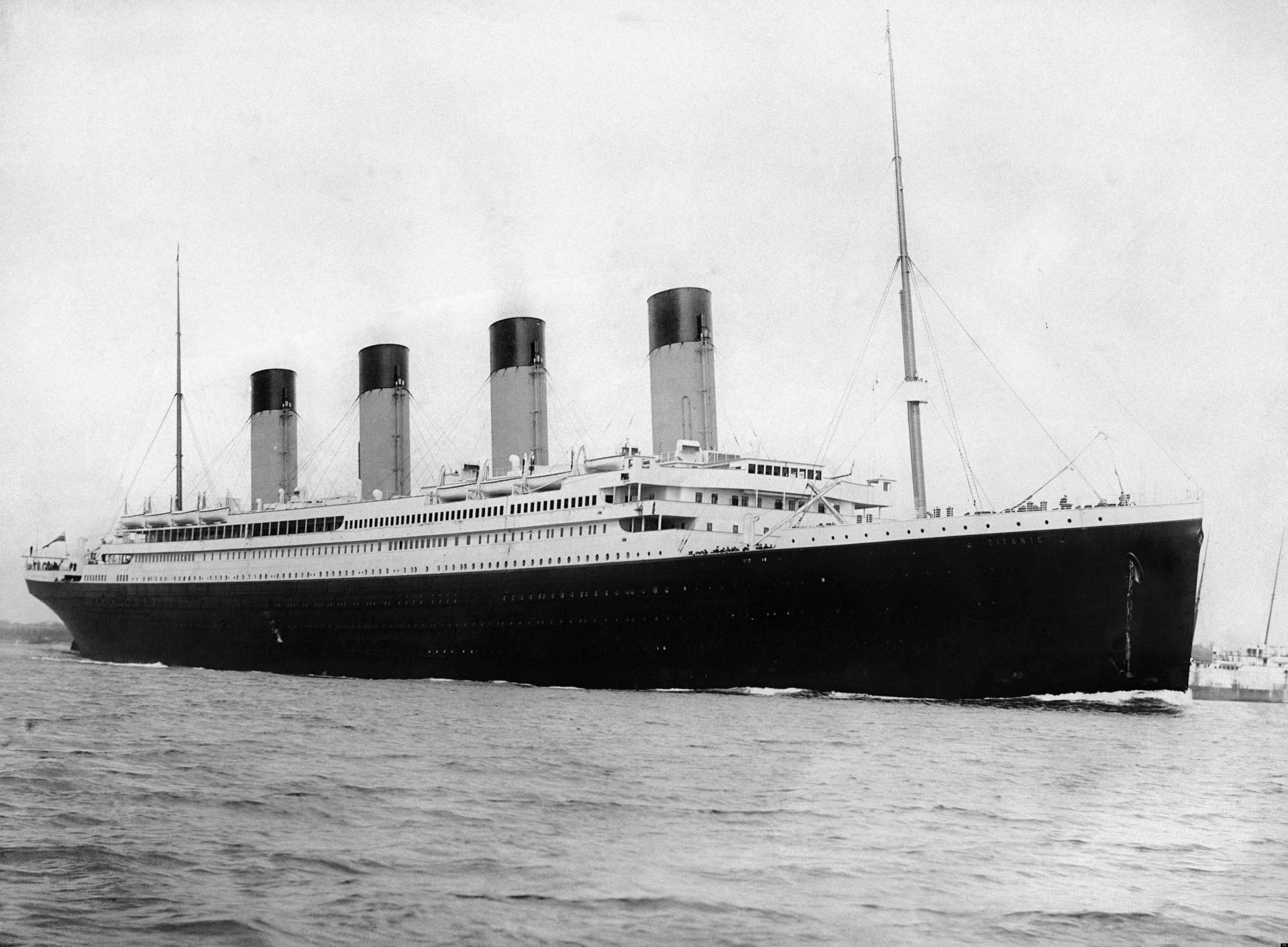

Insolvency specialists at BDO have been appointed administrators of Belfast-based Harland & Wolff, the shipbuilder best known for building the ill-fated Titanic shortly before the First World War.

The Belfast shipyard was founded in 1861 by German Gustav Wolff and Yorkshireman Edward Harland. In its heyday, the yard employed 35,000 workers and was the world's biggest builder of ocean liners. It was a vital supplier in World War Two, producing 123 merchant ships, 140 warships and over 500 tanks.

Sadly, the last time a ship was actually built at the premises was 16 years ago when the company was commissioned to build a ferry called the Anvil Point by the Ministry of Defence. It now employs about 120 staff who work on marine engineering projects such as offshore wind turbines and oil rig refurbishment.

The workers' future at the yard is now in jeopardy and they are currently mounting a protest on the site, which they have taken over. The staff are demanding that the government nationalise the shipyard, arguing that it will be more cost efficient than shutting it down and sending them to join the ranks of unemployed.

The government has responded, saying it is 'ultimately a commercial issue'. Trade unionists are backing the workers and threatening to stand against the DUP in the upcoming elections if the workers are not helped immediately.

The government is well aware of the shipyard's cost to the taxpayer to date. Foreign competition began to bite into the business in the 1950's. This was followed by the universal uptake of air travel, the result of which meant that the last cruise ship built at the yard was the 'Canberra' in 1960. Within five years Harland & Wolff was in financial trouble and so began 30 years of subsidies with the government sinking close to £1 billion in total to keep it running. The business was nationalised in 1975 and remained in the government's ownership until a 1989 management/staff buyout backed by Fred Olsen.

The shipyard has been up for sale since the beginning of the year, not long after the owners, Norwegian-based Fred Olsen Energy, said that they were restructuring and that certain assets may have to be offloaded.

Potential acquirers have been in discussions to buy the business over the past few months, but following the recent breakdown of these talks, the administrators were quick to step in.

There are rumours that several integrated parties, including a ship fit-out operation, are circling the company - but most are only interested in the development potential of the land.

Update: BDO filed for insolvency of Harland and Wolff Heavy Industries Ltd at the High Court in Belfast on 6th August 2019.

This well-established company in the East Midlands offers top-tier, bespoke air conditioning services, excelling in installations, maintenance, and repair for both residential and commercial clients.

This esteemed engineering firm, with over 20 years of industry experience, specialises in providing bespoke turnkey solutions to blue-chip and globally recognised clients, ensuring consistent recurring revenue. The company's strong client relationshi...

This established Cheshire-based business, specialising in linear motion equipment such as linear guides and ball screws from leading global brands, is now available for acquisition.

|

04

|

|

Jul

|

East Midlands furniture manufacturer ceases trading | ADMINISTRATION

Andrew Paul Furniture Limited, a major furniture manufacture...

|

04

|

|

Jul

|

Yorkshire law company Ison Harrison merges with Skipton firm | MERGER

Ison Harrison, an employee owned law firm based in Yorkshire...

|

04

|

|

Jul

|

£37m-turnover pet food firm falls into administration | ADMINISTRATION

Kennelpak Limited, a private equity-backed pet products comp...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.