Wed, 14 Feb 2024 | ADMINISTRATION

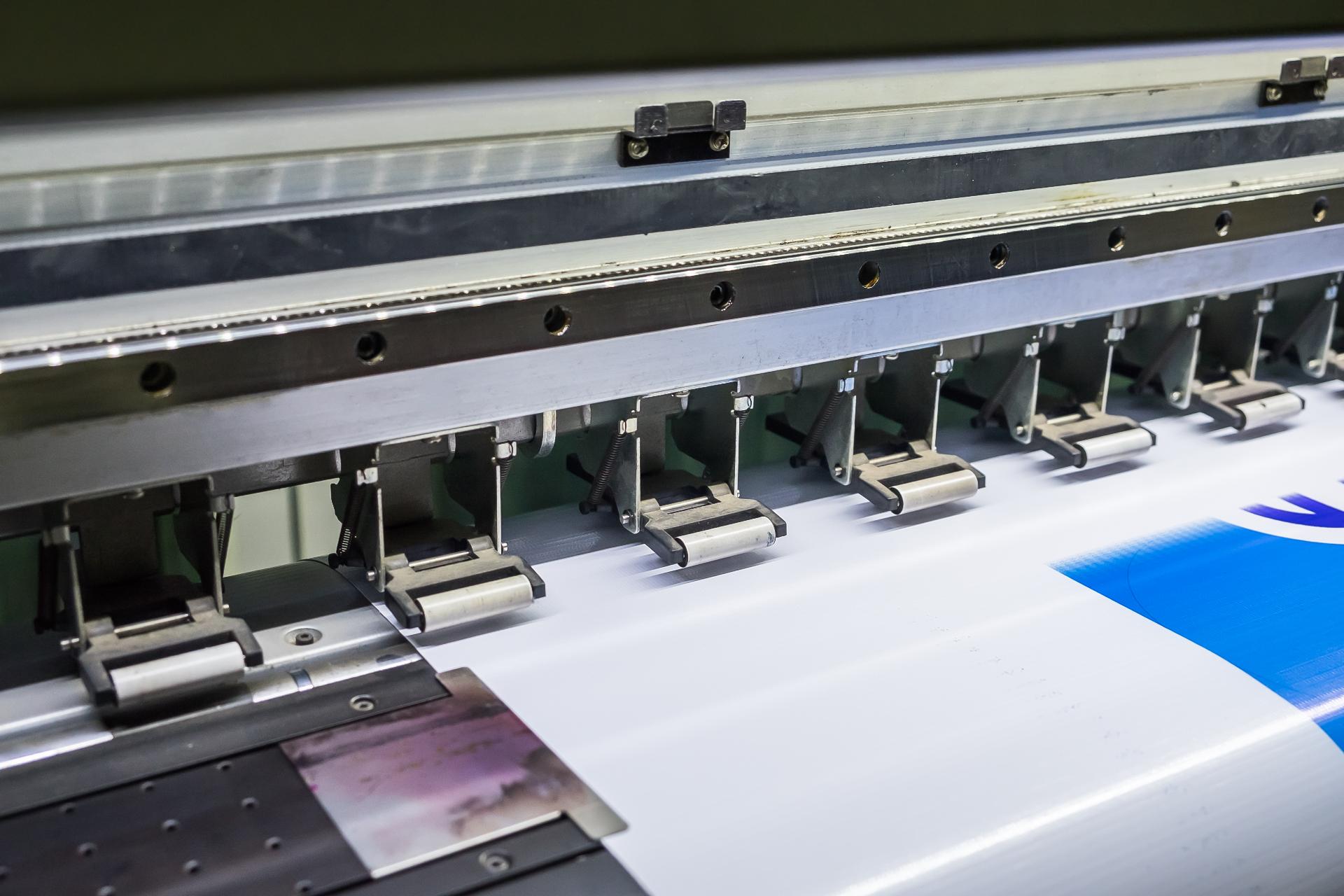

Surepak Limited, a Nottinghamshire-based packaging firm that supplies most major UK supermarkets, has fallen into administration, with a buyer now being sought. The company is a leading flexible packaging manufacturer, supplying bags and pouches to an array of sectors, including gardening, horticulture and confectionery.

The company, which is based at a 45,000 sq ft premises in Annesley and employed 34 staff as of December 2022, serves clients including Tesco, Asda, Lidl, Co-op and M&S and has been trading for more than 30 years.

Surepak was founded in 1991, initially as a distributor, before moving into manufacturing in 1995. The company subsequently relocated to its current 45,000 sq ft facility in 2007. However, its most recent financial accounts indicate the company had outstanding lease payments remaining.

Despite its strong market position, the company has faced growing difficulties over recent years. The global energy crisis has led to its electricity costs reportedly increasing by more than 425 per cent, while it was more recently hit by the loss of two major contracts, which led to a £1 million drop in turnover.

A winding-up petition has been filed against the company, prompting sole director Stuart Yorston to make the decision to appoint Dean Nelson and Nick Lee, Business Recovery Partners at PKF Smith Cooper, as joint administrators.

The company will continue to trade in the short term whilst it is in administration, as the joint administrators begin an accelerated merger and acquisition process in an effort to secure a buyer for all or part of the company.

Joint administrator Nick Lee commented: “Our aim is to preserve the business and protect employees’ jobs, in addition to maximising returns for creditors. We will keep stakeholders and the press informed of any developments as matters progress. If you are interested in purchasing the company, please contact me as a matter of urgency.”

Surepak’s balance sheet as of December 31 2022 shows £1.48 million in fixed assets and slightly over £945,000 in current assets. The company’s liabilities at the time left it with total equity of just under £771,000.

Distressed acquisitions can help to deliver significant growth during economic downturns, but rigorous due diligence is more important than ever

This is a unique opportunity to acquire a bespoke soft furnishings manufacturer with a strong reputation and established relationships with top interior designers, developers, and architects.

Opportunity to acquire a well-established bespoke kitchen manufacturer and retailer with over 30 years of experience in delivering high-quality custom kitchens.

Opportunity to acquire a company renowned for its bespoke wood machining, providing distinctive timber components for various industries including construction and furniture.

|

18

|

|

Apr

|

Household goods retailer Lakeland undergoes a management buyout | MBO/MBI

Windermere-based family-owned household goods retailer, Lake...

|

17

|

|

Apr

|

Manchester tech firm Wakelet bought out of administration | BUSINESS SALE

A Manchester technology company has been bought out of admin...

|

17

|

|

Apr

|

Nutrition company Science in Sports bought by investment firm for £82 million | BUSINESS SALE

Nutrition specialist Science in Sport (SiS) has agreed to be...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.